The enchanting city of Udaipur has rich heritage culture and a thriving environment for financial institutions to flourish. In case you are curious about the NBFCs and their registration process, particularly in Udaipur. Then you are in the right place to have reliable information. From understanding the eligibility criteria to navigating the requirement of documents….

A Limited Liability Partnership (LLP) is a newer way to start a business that gives partners in a partnership more safety from personal liability. LLPs are not their own business entities; for tax reasons, they are treated like limited or general partnerships. In this blog post, we’ll talk about Taxation for Limited Liability Partnerships and…

Non-Banking Financial Companies (NBFCs) are an integral part of the financial system, providing financial services to various sectors of the economy. However, like any other financial institution, NBFCs need to be regulated to ensure that they operate in a safe and sound manner, and protect the interests of their stakeholders, especially borrowers. The Reserve Bank…

There are numerous reasons to invest, right? Some invest to preserve capital. Others invest for capital growth. Others invest so their children can live better than they did. One aspect is crucial and common to all investments. “Nomination for Investments”. “Nominating Someone”. Think about it. Life might surprise us despite our plans. What happens to…

The SEBI (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 regulate the registration and operation of Share Transfer Agents in India. A Share Transfer Agent is an institution that registers and maintains the translation record of securities on behalf of the issuer. Share Transfer Agents must satisfy the capital adequacy criteria for registration…

In the last decade, India’s Digital Lending Industry has grown exponentially, which allow consumers to borrow money from peer-to-peer lenders. However, the industry has largely been unregulated, which has resulted in unchecked third-party participation, misspelling, data privacy violations, unethical recovery techniques, and high interest rates. In this Blog we will have a view about the…

The RBI published a discussion paper in January 2021 outlining a redesigned scale-based regulatory framework for NBFCs, solicited feedback on it. The RBI Scale-based Regulations for NBFCs went into effect on October 1st, 2022. In terms of the Base layer, Middle layer, and Upper layer with reference to the Individual Asset Size and Group Asset…

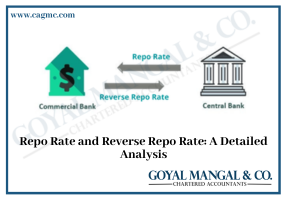

As a regulatory body, the Reserve Bank of Bank (RBI) continuously evaluates its decision to maintain reserves with a view to securing monetary stability in the nation by adopting appropriate measures, such as changes in Repo Rate & Reverse Repo Rate, keeping the primary goal of country’s growth in mind. In this article we will…

As part of Digital Payments Awareness Week (DPAW) 2023, Shaktikanta Das Governor of Reserve Bank of India RBI Launches Mission Har Payment Digital, which aims to make every resident in the country a user of digital payments. This is due to the increasing use of digital payments in recent years. Despite its popularity and adoption,…

The Goods and Services Tax (GST) Act, 2017, is a comprehensive tax system that has replaced several indirect taxes in India. Under this system, taxpayers are required to submit regular returns and comply with various provisions of the law. One important aspect of GST compliance is Summary Assessment, which involves determining the tax liability based…