As a regulatory body, the Reserve Bank of Bank (RBI) continuously evaluates its decision to maintain reserves with a view to securing monetary stability in the nation by adopting appropriate measures, such as changes in Repo Rate & Reverse Repo Rate, keeping the primary goal of country’s growth in mind. In this article we will have a detailed analysis about Repo Rate and Reverse Repo Rate.

|

Table of Content |

What is a Repo Rate?

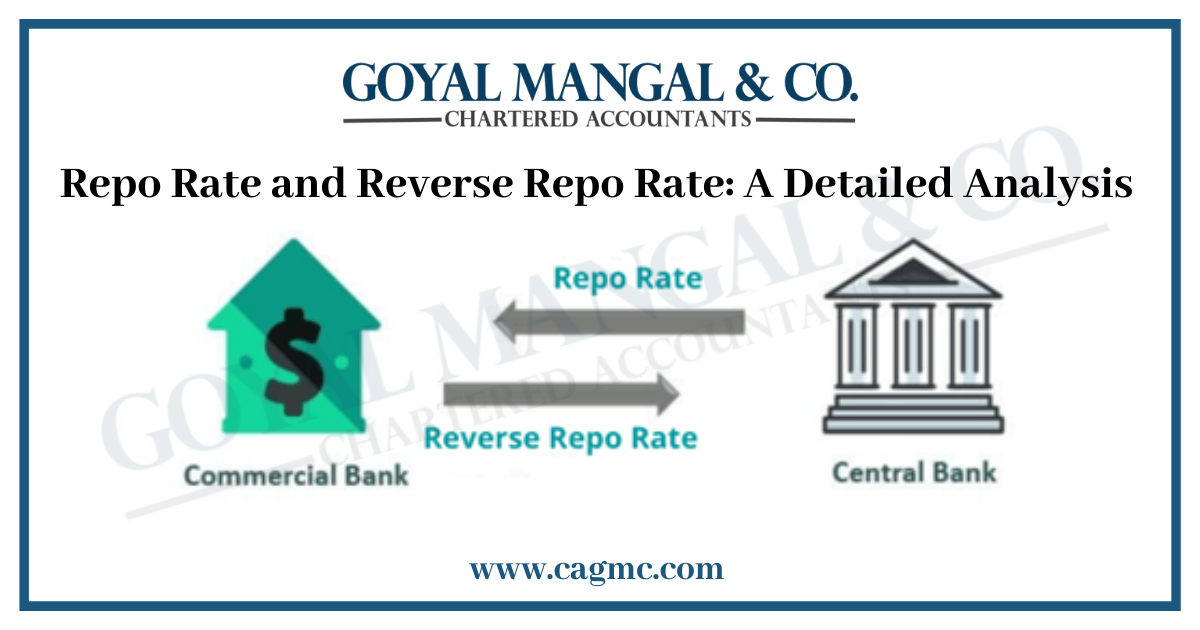

Repo rate is the term used to describe the rate at which commercial banks borrow money by selling their assets to the Reserve Bank of India (RBI), our nation’s Central Bank, to maintain liquidity in the event of a funding shortfall or because of specific legislative requirements. It is one of the RBI’s major measures for controlling inflation.

Repo Rate stands for ‘Repurchasing Agreement’ or ‘Repurchase Option’. Repo Rate is also known as Policy Repo Rate by the RBI.

How does Repo Rate work?

To maintain liquidity, avoid a cash crunch situation, or as a precaution, commercial banks used to borrow money from the Reserve Bank of India (RBI). Each time commercial banks borrow money; they engage into a “Repurchase Agreement” with the Reserve Bank of India that specifies the amount to be borrowed as well as the interest rate (Repo Rate) that will be charged.

Commercial banks must guarantee their Treasury bills, government bonds, or other bonds that are backed by the banks’ underlying liquid assets. This will continue continuously. These loans are typically of the short-term variety.

Components of a Repo Transaction

The criteria listed below are the grounds on which the RBI consents to carry out the transaction with the banks:

- Preventing “squeezes” on the economy: Depending on inflation, the central bank raises or lowers the repo rate. As a result, it seeks to govern the economy by keeping inflation within a certain range.

- Hedging and Leveraging: The RBI seeks to hedge and leverage by purchasing securities and bonds from banks and paying them with cash in exchange for the deposited collateral.

- Short-Term Borrowing: The RBI makes loans for a brief length of time, up to an overnight period, after which the banks are required to purchase back the securities, they have placed at a set price.

- Securities & Collateral: The RBI takes securities & collateral in the form of gold, bonds, etc.

- Liquidity: To preserve liquidity or cash reserves as a safety measure, banks borrow money from the RBI.

Impact of Repo Rate

The Repo rate impacts various factors such as:

- Home Loan: The specifics of these loans must be understood by buyers who take out a home loan related to repo rates or those who switch from their current home loans to them. Transmissions move more quickly. Any changes to the repo rate are likely to be reflected in your EMI outlay far sooner. This implies that if the financial authority changes its benchmark lending rate, your house loan EMI would likewise increase. Furthermore, banks will finally choose how much additional interest they will add to the mortgage repo rate.

- Fixed Deposits: The repo rate increase might be quite advantageous for investors looking for fixed deposits with minimal risk and attractive yields. As investments, FDs are anticipated to increase in value. Changes to the RBI’s policy repo rate will influence bank lending and deposit rates. The different banks and NBFCs will decide on the actual rate modifications.

- Stock Market: The stock market and interest rates are mutually exclusive. The repo rate is immediately impacted if the Central Bank increases it. In other words, the increase in the repo rate discourages companies from investing in expansion, which slows growth, affects earnings and future cash flows, and lowers stock values.

Effect of Repo Rate on Economy

A key component of Indian monetary policy, the repo rate has the ability to control the nation’s liquidity, inflation, and money supply.

Additionally, the amount of repo directly affects how much it costs banks to borrow money. The cost of borrowing for banks will increase when the repo rate increases, and vice versa.

- Rise in Inflation: The RBI works hard to reduce the flow of money into the economy when inflation is high. Increasing the repo rate is one method of achieving this. Because of this, borrowing becomes expensive for firms and sectors, which in turn reduces investment and the amount of money available on the market.

As a result, it has a negative effect on economic expansion, which aids in keeping inflation under control.

- Increasing Liquidity in Market: On the other hand, the RBI reduces the repo rate when it has to inject money into the system. As a result, borrowing money for various investment goals is more affordable for enterprises and industries. Additionally, it expands the economy’s overall money supply. This ultimately accelerates the economy’s growth pace.

What is Reverse Repo Rate?

Reverse Repo rate is the rate at which money is borrowed by the Reserve Bank of India (RBI) from Commercial Banks I.e., Reverse Repo Rate is a process to absorb the liquidity in the market, thus restricting the borrowing power of investors.

How does Reverse Repo rate works?

The market’s liquidity is absorbed by the reverse repo rate, which limits investors’ ability to borrow money. When there is too much liquidity in the market, the RBI will borrow money from banks at the reverse repo rate. By earning interest on their securities with the central bank, the banks profit from it.

The RBI raises the reverse repo when the economy experiences high levels of inflation. It encourages banks to deposit more money with the RBI to receive better returns on their excess cash. Less money is available for banks to lend to and borrow from consumers.

What is Base point?

Basis points also known as BPS are a unit of measurement used in finance to describe the rate of change in an index or other benchmark or the percentage change in the value of financial instruments. One basis point is equivalent to 0.0001 or 0.01% (1/100th of a percent) in decimal notation.

Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) is a committee responsible for making decisions about the policy interest rate to influence other interest rates in the economy.

- Prior to MPC creation: Prior to the creation of the Monetary Policy Committee (MPC), the governor of the Reserve Bank of India used to make important decisions regarding benchmark interest rates based on advice from a Technical Advisory Committee (TAC) made up of professionals in the fields of banking, public finance, and economics. Since the governor of the RBI is a person appointed by the government, that authority may be revoked at any time. Particularly during periods of poor growth and high inflation, this was causing uncertainty and resulting in conflict between the government and the RBI.

- After MPC creation: The Reserve Bank of India Monetary Policy Committee and Monetary Policy Process Regulations, 2016″ established the Monetary Policy Committee (MPC). The benchmark interest rate in India is set by the Monetary Policy Committee.

The participants must adhere to a “silent period” Seven days are allotted for “utmost confidentiality” before and after the rate decision. The committee’s ex officio chair is the governor of the Reserve Bank of India.

In the event of a tie, the governor has the casting vote. Decisions are made by majority vote. Each member’s comments on the monetary policy are published following each meeting. If the inflation exceeds the target range for three consecutive quarters, the committee must answer to the Indian government.

Takeaway

As a regulatory body, the Reserve Bank of Bank (RBI) continuously evaluates its decision to maintain reserves with a view to securing monetary stability in the nation by adopting appropriate measures, such as changes in Repo Rate & Reverse Repo Rate, keeping the primary goal of country’s growth in mind.