In today’s dynamic business landscape, companies often explore various restructuring options to adapt to changing market demands and expand their operations. One such transformational journey is the conversion of a Limited Liability Partnership (LLP) to a Private Limited Company. This strategic shift allows businesses to unlock new opportunities, enhance their corporate structure, and access a…

Company Registration Process in Rajasthan is a crucial process for entrepreneurs looking to establish their businesses in the state. This legal procedure grants recognition, protection, and access to government incentives. Understanding the various business structures, compiling essential documents, and adhering to registration requirements are vital steps. Entrepreneurs can choose between online and offline registration options,…

As the Goods and Services Tax (GST) continues to be a vital part of the modern tax system, the role of GST Practitioners has become increasingly essential for businesses and taxpayers alike. These skilled professionals play a crucial role in simplifying the complexities of GST compliance and ensuring smooth tax operations. Whether you’re a tax…

Welcome to our blog on Appeals under the Goods & Service Tax (GST) system. If you are a business owner or tax professional, you know how challenging it can be to navigate the appeals process. However, understanding how appeals work is essential for ensuring a fair resolution and minimizing financial and operational impacts. In this…

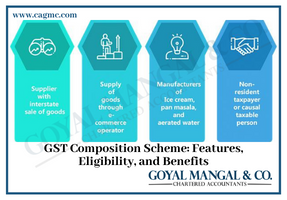

The Goods and Services Tax (GST) Composition Scheme is a concept of simplified taxation, which is introduced by the Indian government to relieve the compliance burden on small businesses. Under GST Composition Scheme, several eligible enterprises can attain benefits like a simplified filing process, reduced tax rates, etc. This article, main aim is to provide…

Through the time of Goods and Services Tax (GST), there is huge significant changes have been seen in the way of businesses and individuals pay taxes. One essential concept that every taxpayer should grasp is the “Point of Taxation.” This pivotal aspect determines the moment when the liability to pay GST arises, shaping the calculation…

The implementation of the Goods and Services Tax (GST) in India has had a significant impact on various sectors, including the vibrant textile industry in Rajasthan. As one of the leading textile hubs in the country, Rajasthan has witnessed both positive and negative consequences resulting from the GST regime. In this insightful article post, we…

GSTR-5 is a return filed under the Goods and Services Tax (GST) system in India. It is mainly designed for non-resident foreign taxpayers who are registered under GST and provide taxable services in India. Taxpayers are required to file GSTR-5 to report their business activities and fulfil their compliance obligations. The GST regime was introduced…

The Goods and Services Tax, also known as the GST, has had a significant impact on the way supply chains are managed. The introduction of the Goods and Services Tax (GST) in India has led to the unification of multiple levies into one, which has eradicated the cascading effects that were previously there. The GST…

Every tax system advises firms on methods to comply with laws. Firms must submit returns on time, pay taxes regularly, and retain records under a tax system. Small business owners lack the knowledge and expertise to comply with such regulatory obligations. Small enterprises can pay a composition charge. This increases compliance without the hassle of…