In recent years, India has witnessed a remarkable transformation in the way individuals make payments and manage their finances. The digital wallet has revolutionized the financial landscape, giving a convenient and secure solution for conducting transactions in an increasingly cashless society. With the flow of smartphones used in India, government initiates and changing consumer preferences, the digital wallet business in India has experienced enormous growth and has become an integral part of the country’s digital economy. In this article, we will explore the Digital Wallets Business in India. Along with that, we delve into the key players in the industry, government regulations, technological advancements, and the various factors shaping the digital wallet landscape. Furthermore, we examine the benefits and challenges faced by businesses operating in this dynamic ecosystem.

| Table of Content |

What do you mean by Digital Wallet?

Digital wallets, also known as e-wallets or mobile wallets. These are virtual wallets that allow individuals to store, manage, and transact digital currencies or payment methods using electronic devices. For instance, as smartphones, tablets, or computers. These wallets securely store various types of payment information. Including credit card details, debit card details, bank account information, or digital currencies like Bitcoin or Ethereum.

Digital wallets serve as a digital equivalent of a physical wallet. It offers a convenient and secure way to make transactions both online and offline. They provide a range of functionalities, which may vary depending on the specific wallet provider and the region where it is used.

Feature of Digital Wallet Business in India

Some common features of digital wallets business include:

- Storage of payment information: Users can securely store their payment card details, bank account information, or digital currency holdings within the digital wallet.

- Online purchases: Digital wallets enable users to make payments for goods and services on e-commerce platforms, online marketplaces, or mobile apps. Users can often complete transactions with just a few clicks or taps, without the need to manually enter payment details for each transaction.

- Peer-to-peer transactions: Digital wallets often facilitate peer-to-peer transactions. They are allowing users to send and receive money or digital currencies to and from friends, family, or other wallet users. This can be useful for splitting bills, repaying debts, or sending gifts.

- Contactless payments: Many digital wallets support contactless payments using near-field communication (NFC) technology. Users can simply tap their smartphones or other devices on compatible payment terminals to complete transactions at physical stores.

- Bill payments: Digital wallets may offer the functionality to pay utility bills, mobile phone bills, internet bills, or other recurring payments directly from the wallet. Users can conveniently manage and schedule bill payments within the wallet app.

- Loyalty programs and rewards: Some digital wallets integrate with loyalty programs and offer rewards or cashback for transactions made through the wallet. Users can accumulate points or discounts for future purchases.

Digital Wallet Business in India

The digital wallet business in India has witnessed significant growth and popularity over the past years. A digital wallet, also known as an e-wallet or mobile wallet, is a virtual wallet that allows users to store money and make digital transactions through their smartphones or other mobile devices. Several factors have contributed to the expansion of the digital wallet industry in India:

- Demonetization: In November 2016, the Indian government implemented a demonetization policy that aimed to reduce the circulation of cash and promote digital payments. This move created a surge in digital wallet usage as people sought alternative means of making transactions.

- Increased smartphone penetration: India has experienced a rapid increase in smartphone adoption, especially in urban areas. The availability of affordable smartphones and affordable data plans has enabled more people to access digital wallets and engage in mobile-based transactions.

- Government initiatives: The Indian government has launched various initiatives to promote digital payments. Such as the Unified Payments Interface (UPI) and the Bharat Bill Payment System (BBPS). These initiatives have simplified and streamlined digital transactions, making it easier for digital wallet providers to offer their services.

- Convenience and security: Digital wallets provide users with convenience and security in making payments. Users can link their bank accounts, credit cards, or debit cards to their digital wallets. Enabling quick and seamless transactions without the need to carry physical cash or cards. The adoption of robust security measures, such as two-factor authentication and encryption, has increased user confidence in using digital wallets.

- Digital Wallet companies operating in India

Prominent digital wallet companies operating in India include:

- Paytm: Paytm is one of the leading digital wallet providers in India. It is offering a range of services such as mobile recharges, bill payments, money transfers, and online shopping.

- PhonePe: It is a popular digital wallet and UPI-based payment app. It allows users to send and receive money, pay bills, and make online purchases.

- Google Pay: Google Pay (formerly Tez) is a UPI-based digital payment app that enables secure transactions using smartphones. It offers features like bill payments and money transfers.

- PayZapp: It is a digital wallet by HDFC Bank that offers a range of services. Including bill payments, mobile recharge, ticket bookings, and more.

- MobiKwik: It is another well-known digital wallet provider that enables users to make payments, recharge phones, pay utility bills, and shop online.

- These digital wallet companies often collaborate with merchants, online platforms, and service providers to expand their acceptance and offer attractive cashback rewards and discounts to users.

Factors Affecting the Digital Wallets Business in India

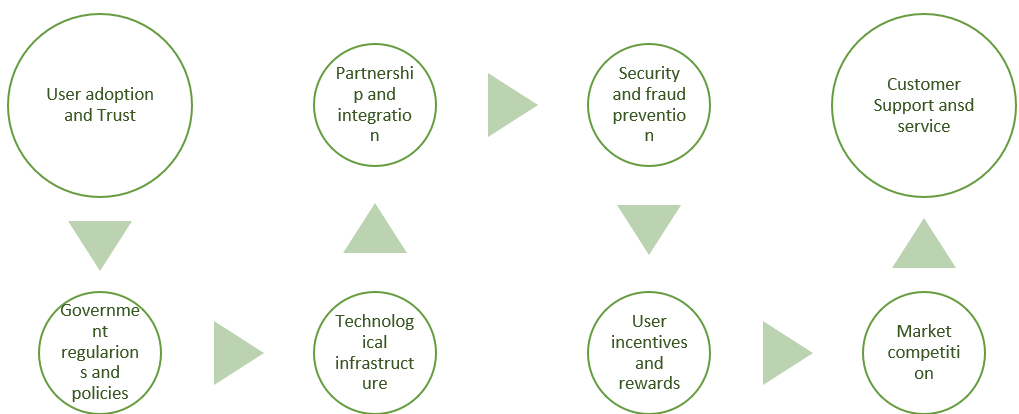

The digital wallet business model is influenced by several key factors that can significantly impact its success and growth. Here are some important factors that affect the digital wallet business model:

- User adoption and trust: The success of a digital wallet depends on user adoption and their trust in the platform. Factors such as user experience, ease of use, security features, and reliability. These play a crucial role in building user confidence and encouraging widespread adoption.

- Government regulations and policies: Digital wallet businesses are subject to regulatory frameworks and policies set by governments and regulatory authorities. These regulations may include guidelines for user identification, data privacy, transaction limits, and security standards. Complying with these regulations is essential for the smooth operation of digital wallet businesses.

- Technological infrastructure: The availability and reliability of the technological infrastructure, such as internet connectivity, mobile network coverage, and digital payment infrastructure. Impact the functionality and usability of digital wallets. A robust technological infrastructure is crucial for seamless and efficient digital transactions.

- Partnerships and integration: Collaborations with banks, financial institutions, merchants, and service providers are essential for the success of digital wallets. Partnerships enable digital wallets to expand their acceptance network, offer a wider range of services, and provide added value to users. Integration with popular e-commerce platforms, online marketplaces, and other digital services can drive user engagement and usage.

- Security and fraud prevention: Security is a critical aspect of the digital wallet business model. Building trust among users requires implementing robust security measures to protect sensitive user data and prevent fraud. Incorporating technologies like encryption, tokenization, multi-factor authentication, and transaction monitoring systems help enhance the security of digital wallets.

- User incentives and rewards: Offering attractive incentives, rewards, and cashback programs can incentivize users to adopt and use digital wallets. Such programs can include discounts on purchases, loyalty programs, referral bonuses, or exclusive deals with partner merchants. User incentives play a vital role in increasing user engagement and driving transaction volumes.

- Market competition: The digital wallet industry is highly competitive, with multiple players vying for market share. The strategies, features, and user experience offered by competitors can impact the success of a digital wallet business. Continuous innovation, differentiation, and staying ahead of competitors are crucial for sustaining growth in the competitive market.

- Customer support and service: Providing reliable and responsive customer support is essential for addressing user queries, resolving issues, and ensuring a positive user experience. Efficient customer service helps build trust and loyalty among users, contributing to the success of the digital wallet business.

Takeaway

The Digital Wallets Business in India has emerged as a transformative force in the financial landscape, providing users with convenient, secure, and cashless transaction options. In India, the digital wallet industry has experienced significant growth, driven by various factors mentioned above. As India moves towards a cashless economy, digital wallets continue to play a vital role in transforming the way people transact and manage their finances. With ongoing technological advancements, increasing financial literacy, and evolving customer needs. The Digital Wallets Business in India holds promising opportunities for growth and innovation.