Finance Minister Nirmala Sitaraman has recently introduced a new facility in Budget 2020 in which individuals can get instant Permanent Account Number (PAN) through their Aadhaar without submitting a detailed application form.

Requirements for instant E-PAN

For application of E-PAN, no document is required to be uploaded on the portal for application of PAN. The E-PAN facility is only available for those who do not have PAN.

For PAN application, your mobile phone number must be linked to Aadhaar number and the complete date of birth in DD-MM-YYYY format should be available on the Aadhaar card. This instant e-PAN card facility is not available for the minors.

Steps to get instant E-PAN

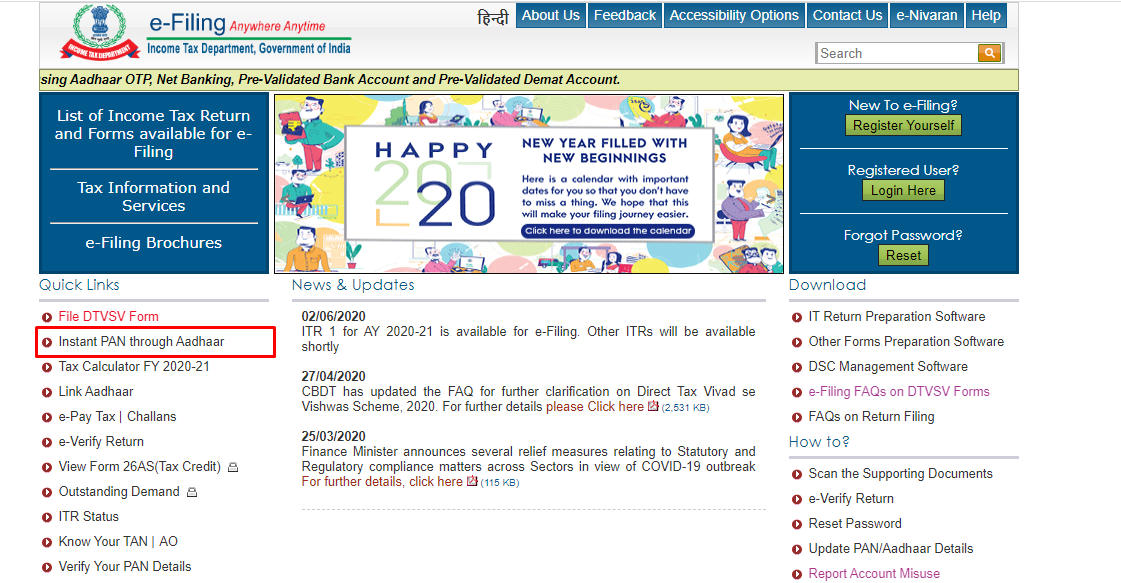

Step 1: Visit to www.incometaxindiaefiling.gov.in

Step 2: Under this ‘Quick Links’ option, click on the ‘Instant PAN through Aadhaar’.

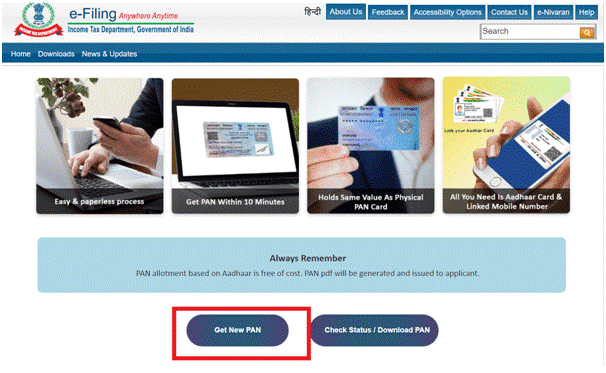

Step 3: Select from the following options:

- To get new PAN click on ‘Get New PAN’

- And to check PAN status click on ‘Download PAN’

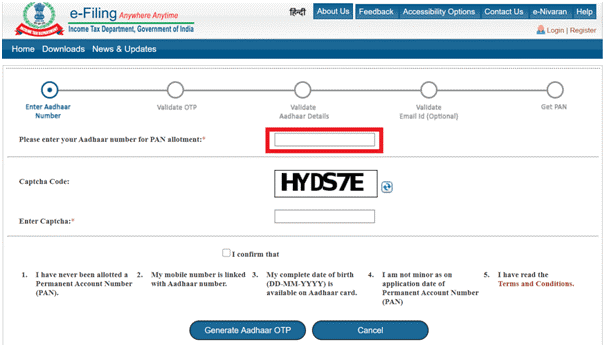

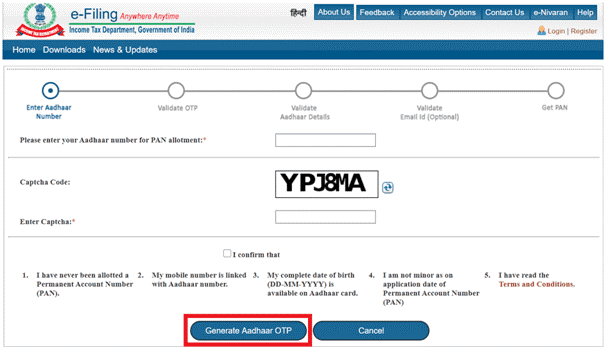

Step 4: After this enter your Aadhaar number, captcha code and right tick on ‘I confirm that’

Step 5: Then click on ‘Generate Aadhaar OTP’. A one-time password (OTP) has been sent on your registered mobile number that is registered with the Aadhaar database.

Step 6: After generating OTP enter the OTP in the required space. Then click on ‘Validate Aadhaar OTP and confirm’.

Step 7: On successful verification of Aadhaar OTP, check if the name, date of birth, residential address, mobile number and other details shown are correct.

Step 8: Verify the e-KYC details and agree to consent and submit a request for PAN allotment

Step 9: Once the details are submitted successfully, an acknowledgment number will be generated and that acknowledgment number will be sent to you via SMS and email (if given).

Step 10: Once you have applied for PAN using this facility, you can view the status or download the PAN by entering Aadhaar number, captcha and OTP received on your registered mobile number. A Permanent Account Number (PAN) is issued instantly in just 10 minutes in PDF format to the applicant.

Is this E-PAN valid?

Yes, E-PAN card is valid. It is not different from the PAN issued by the income tax department via other modes of application. However, this E-PAN is prepared online, it is easy to prepare by any person, it is paperless, and free of cost.