Benefits of FCRA Registration

The benefits of FCRA registration are many. Some of them are-

-

Foreign Investment-

The benefit of FCRA registration is continuous support and investment from foreign entities. Support can be from a registered foreign head office or another foreign entity. -

Compliance-

Entities that are registered with the FCRA requirement would comply with the relevant regulations. -

Donations-

FCRA registered entities can accept donations from foreign entities. -

Government Support-

When organizations are registered under FCRA, it helps the organization to legally receive foreign contributions or government assistance. As a result, the applicant may utilize full-state assistance through this registration process. -

Recognition-

Usually, this form of registration is done for companies and NGOs. NGOs relying on foreign funds require registration under FCRA requirements. An entity would have a good reputation in society.

Eligibility for FCRA registration

The organization’s principal goal must be charitable work or societal service without a profit-making objective, such as in the areas of health, education, the arts, culture, entertainment, etc. The other criteria include-

- Minimal term

The applicant must have been registered and in business for at least three years before requesting registration. - Accounting Statements

The last three financial years' financial statements must be signed by an authorized accountant, and both the revenue and expense statements and financial statements must be provided. - Minimal costs

The primary goal of the NGO was to receive a minimum of Rs. 10 lakhs, excluding any administrative costs. - Registering of an NGO

The applicant must be registered by the aforementioned Acts, including the Trusts Act of 1882, the Companies Registration Act of 1860, and Section 8 of the Companies Act, which requires that NGOs be registered under the Companies Act 2013.

Documents of FCRA Registration

The documents required for FCRA Registration are as follows-

- Certified copy of the certificate of incorporation or trust

- Data on the non-profit organization and PAN

- A copy of the founding agreement and articles of association

- Certificate issues as per under Section 12AB of the Income Tax Act

- Impression of the chief functionary

- Certified true copies of the governing body's resolution

- Detailed activity report for the previous 3 years

- Audited financial statements

Procedure to apply for FCRA registration

The procedure to apply for FCRA Registration is-

-

To begin the FCRA online registration process, go to the web site in step 1. To continue, click "Forms".

-

Depending on the type of registration, select either "Application for FCRA Registration Form FC - 3A" or "Application for FCRA Prior Permission-Form FC - 3B.".

-

After that, select "Apply Online" and "Sign Up" to create your username and password. Once the applicant has successfully registered, a message authenticating the account's creation will show up on the screen.

-

To access your account, enter the username and password you previously created. Before continuing, select FCRA Registration from the list of options.

-

On the following screen, select "FC-3" from the title bar to start a fresh registration procedure.

-

Fill out the form completely, making sure to include the organization's name and contact details.

-

By selecting "Executive Committee" from the navigation bar, complete the Executive Committee form.

-

To add, remove, or amend key feature details, enter the required information in the "Add key feature details" box.

-

Upload to the website the necessary PDF documents. Use one of the several payment options to complete the registration process.

Validity of FCRA License

An FCRA registration is valid for 5 years after its approval. If the registered entity is engaged in continuous activities, a renewal application must be submitted at least 12 months before the registration expires. At least six months before to the term’s expiration, the registered entity must notify the other party.

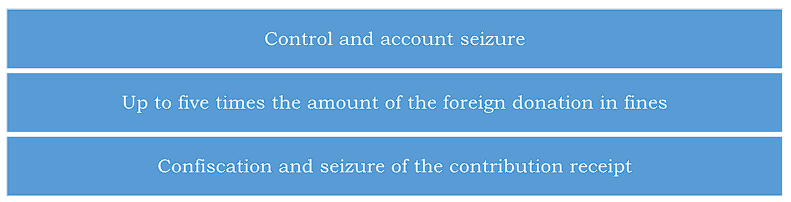

Non-Compliances for FCRA Registration

Final words

Registration under the Law on the Regulation of Foreign Contributions offers many benefits to organizations engaged in social and charitable activities by facilitating the legal receipt of foreign contributions, expanding funding sources, increasing credibility, and enabling cooperation with international donors and partners.

FAQs on FCRA Registration

The FCRA registration certificate is valid for 5 years after it has been authorized. To keep the FCRA registration active, a renewal application must be submitted six months before the registration expires.

Any donation made in foreign money or Indian rupees from a “foreign source” is classified as a “foreign contribution.”

The FC-4 annual compliance form must be submitted on or before December 31st of each year, nine months following the end of the financial year.

No, contributions from abroad cannot be combined with local receipts.

FC-4 form.

FC-7 form.

Six months before the registration’s validity period expiring, an application for an extension must be made.

FCRA registration under the Foreign Contribution (Regulation) Act is required for organizations in India that receive foreign contributions or donations from foreign sources.

Entities eligible for registration under the Foreign Contribution Regulation Act include trusts, companies, and Section 8 companies registered under Indian laws.

Yes, a company’s registration under the Foreign Contribution Regulation Act may be cancelled if it violates FCRA guidelines, engages in criminal activity, or fails to adhere to the Act’s requirements.