| Table of Content |

The Union Budget 2021 was Presented by The Finance Minister , Smt. Nirmala Sitharaman in parliament on 1st February 2021. It was the first-ever digital Union Budget as Govt. had decided not to print the budget documents. The Finance Bill 2021, proposed 80+ amendments to the Income-tax Act and other related Acts. And there is no changes in slab rates.

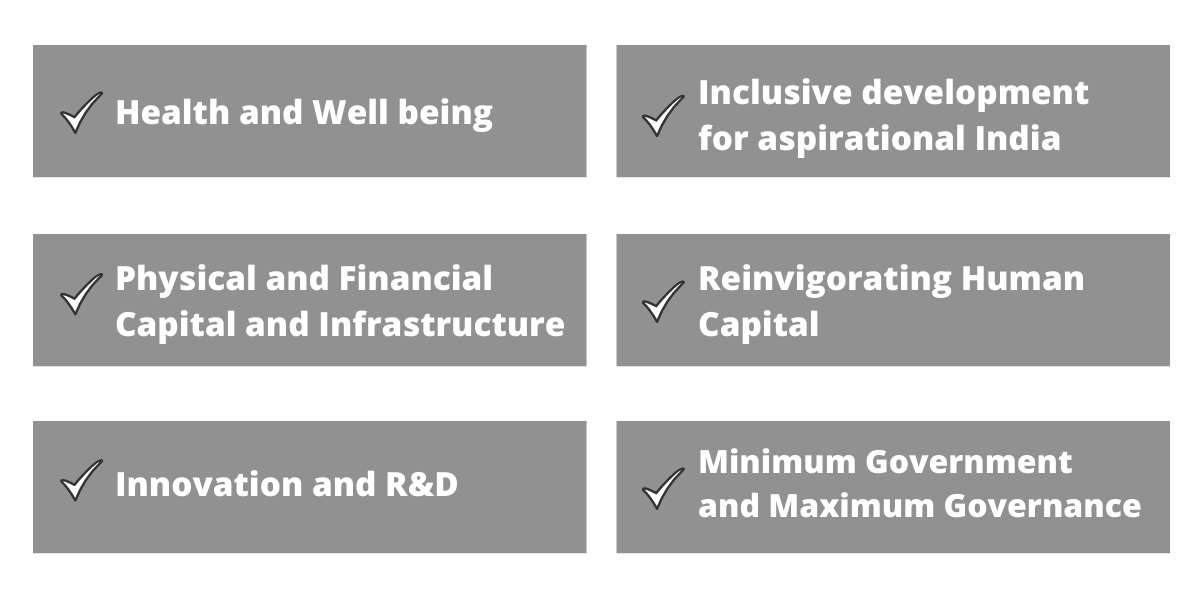

6 pillars of Union Budget 2021-22:

The key highlights of the Finance Bill 2021 are as follows :

INCOME UNDER HEAD SALARIES:

- Exemption for LTC Cash Scheme: As per section 10(5) An employee receives Leave Travel Concession (LTC) from his employer for going on vacation in India, the amount so received shall be exempt from tax . Due to covid-19 and lockdown, employees have not been able to avail benefit of Leave Travel Concession (LTC) in the current block of 2018-21. Thus, to provide relief to employees, the aforementioned section has been amended .However , Exemption under this section allowed subject to condition:

That The amount so received should be incurred by the assessee or a member of his family during the period between 12-10-2020 to 31-03-2021 on goods or services which attract GST rate of 12% or more. - Taxability of Interest on Provident Fund: The exemption shall not be available for the interest income accrued during the previous year on the recognised and statutory provident fund in the account of the person to the extent it relates to the contribution made by the employees in excess of Rs. 2,50,000 in a previous year

- No deduction to employer for employee’s contribution if not deposited before the due date: The deduction to employer for employees contribution towards any welfare fund is only allowed if such sum is credited by the employer to the employee’s account in the relevant fund on or before the due date prescribed.

PROFITS AND GAINS FROM BUSINESS AND PROFESSION:

- LLPs are not eligible for presumptive taxation scheme under Section 44ADA: Section44ADA allows professionals to calculate and pay tax on a presumptive basis. The amendment proposes to specify an exclusive list of the assessee who are eligible for the presumptive taxation scheme prescribed under Section 44ADA. According to this section , an Individual, HUF or a Partnership Firm, not being an LLP, shall be eligible to opt for presumptive taxation scheme under Section 44ADA.

- Threshold limit for tax audit to promote digital transactions: If at least 95% of the business receipts and payments are made through electronic modes, the threshold limit for the tax audit is proposed to be increased from Rs. 5 crores to Rs. 10 crores from the assessment year 2021-22

- No MAT on dividend income of a foreign company :Dividend received by a foreign company on investment in India shall be excluded for calculation of book profit in case the tax payable on such dividend income is less than MAT liability on account of concessional tax rate provided under DTAA.

- No depreciation shall be allowed on goodwill: The Finance Bill, 2021 has proposed that no depreciation is claimed on goodwill. It has been Proposed that in the definition of intangible assets for calculation of depreciation “block of assets shall not include goodwill” whether acquired or self-generated. It also proposed to be amended to provide that if the assessee has claimed depreciation on goodwill before the Assessment Year 2021-22, then the cost of purchase of such goodwill will be reduced by such amount of depreciation while computing capital gains.

- Exemption in respect of income chargeable to Equalization Levy: It has been proposed that exemption will apply for the e-commerce supply or services made or provided or facilitated on or after 01-04-2020 on which equalization levy is levied. Further, no exemption will apply for royalty or fees for technical services which are taxable under the Income-tax Act read with the Double taxation avoidance agreement.

INCOME UNDER THE HEAD CAPITAL GAIN:

- All Type of transfer are included in the scope of slump-sale: The scope of term slump sale is proposed to be expanded to cover all types of transfers

- Taxation of unit linked insurance policy (ULIP) with annual premium above Rs.2.5 lakh: There will be taxation on maturity proceeds of unit-linked insurance policies (ULIPS) issued on or after 01-02-2021 with an annual premium above ₹2.5 lakh, according to the budget provisions. However, the amounts received under ULIP policies on death of the policyholder will remain exempt from tax.

- Revision in safe harbour limit u/s 43CA, 50C and 56 on transfer of immovable property below SDV: As per section 43CA if immovable property sold for consideration below stamp duty value then, the SDV will be deemed to full value of consideration . except the difference between SDV and actual consideration does not exceed 5% of actual consideration Now, this limit increases to 10% of actual consideration . And To boost the demand in the real-estate sector and to enable the real-estate developers to liquidate their unsold inventory at a lower rate to home buyers, the safe harbour limit is proposed to increase from existing 10% to 20% in case of transfer of residential property during the period from 12-11-2020 to 30-06-2021 by way of first-time allotment to any person. Further, the consideration received or accruing on transfer should not exceed Rs. 2 crores.

- Extension in time limit on transfer of residential house property for Section 54GB exemption: Section 54GB provides for exemption of capital gain which arises from transfer of capital asset i.e., a residential house or a residential plot of land , provided the eligible assesse required to invest the net consideration in the equity shares of an eligible start-up before the due date of furnishing of return of income and such start-up is required to utilize the said investment for purchase of new asset within one year from the date of investment by the assessee . This exemption is only available if the residential property is transferred on or before 31st march 2021.The Finance Bill 2021 has proposed to extend the said date of transfer of residential property to 31-03-2022.

RETURN OF INCOME:

- Reduction in time limit for filling belated or revised return: The time limit for filing of belated return or revised return is reduced by 3 months. As per Finance Bill, 2021 the belated or revised return can be filed on or before December 31 of the assessment year or before the completion of the assessment, whichever is earlier.Income Tax Return Filing for Senior Citizens: Resident Senior citizens of 75 years and above would not be required to file income tax returns for the financial year. Such relief will only be available if the following conditions are satisfied:

-

- He has pension and/or interest income from the same bank and the bank is notified by the Government

- He is required to file declaration to the bank in such form and verified manner as may be prescribed.

- Revision in the time limit for processing of ITR and issuance of notice: As per the proposals of Finance Bill 2021, now income tax department is required to send Intimation u/s 143(1) within 9 months from the end of the financial year in which return is furnished, earlier it was one year. And , the time-limit to serve a notice for scrutiny assessment is also proposed to be reduced from 6 years to 3 years from the end of the financial year in which return is furnished.

- Income tax authority can also issue notice to file return of income: Earlier, this notice could be issued only by the Assessing Officer. Now, the prescribed Income-tax authority would be empowered to issue a notice to a person to furnish his return of income.

- Adjustments to be made by CPC while processing ITR: The CPC while processing the return of Income can make an adjustment for any increase in income due to mismatch in the income disclosed in the tax audit report and income computed in the Income-tax return.

TDS/TCS PROVISIONS:

- TDS ON DIVIDEND (SECTION 194) :SEC.194 provides that no TDS will be deducted if dividend credited or paid to certain insurance companies or insurers. From AY 2020-21, it is proposed that no TDS shall be deducted if dividend is credited or paid to a business trust by a special purpose vehicle or payment of dividend to any other person as may be notified.

- TDS on purchase of goods( Section 194Q ): It is proposed to be inserted for deduction of TDS by a person (whose turnover exceeds Rs. 10 crores) who is paying any sum to any resident for purchase of any goods of the value exceeding Rs. 50 lakhs in any previous year. The tax shall be deducted at the rate of 0.1%, which shall be increased to 5% if the seller does not provide his PAN.

- TDS at higher rates in case non filling of ITR: Section 206AB and Section 206CCA are inserted as per finance Bill 2021, which provides that now customers/ payers will need to deduct higher rate of TDS i.e., twice the normal rate or 5% whichever is higher from their vendors, if such vendors have not filed their ITR for two consecutive years immediately preceding the relevant financial year, for which due date for filing the ITR is already expired and aggregate amount of TDS/ TCS for such vendor in each of these two years should be at least Rs 50,000. Similar provision is introduced as Section 206CCA, for the TCS.

- TDS on payment made to FPIs(section 196D): Anyone who is responsible for paying any income (other than the interest payable in respect of Rupee Denominated Bond of an Indian company or Government Security) to foreign portfolio investors (FPIs) in respect of securities is liable to deduct tax under section 196D. The said section provides for deduction of tax at the rate of 20%.As FPIs are incorporated outside countries, their taxability in India is also subject to double taxation avoidance agreements (‘DTAAs’). Thus, considering the applicability of DTAA in case of FPIs, Section 196D is amended to provide that tax shall be deducted at the rate provided under DTAA or at rate of 20% whichever is lower.

PROVISIONS REGARDING CHARITABLE / RELIGIOUS TRUST

- Set-off of deficit not to be permitted to Charitable Institutions: It has been proposed that the charitable trusts shall not be allowed to claim any carry forward of losses. Therefore, no set-off/deduction/allowance of any excess application of any preceding year shall be permitted while computing income .

- Amount applied out of loans not to be considered as an application of Income: Finance Bill 2021, proposed that utilization of borrowed money shall not be considered as an application of income for charitable or religious purposes. However, when loan or borrowing is repaid from the income of the previous year, such repayment shall be allowed as an application in the previous year in which it is repaid.

- Exemption of Corpus Contributions to the extent it is invested : Voluntary contributions made with a specific direction that it shall form part of the corpus shall be eligible for exemption only if it is invested/deposited in specified modes maintained specifically for such corpus. Further, the amount spent from such corpus shall not be considered as an application against the mandatory 85% application of non-corpus income.

PROVISIONS RELATED TO DEDUCTIONS:

- Revision in the time-limit for sanction of housing loan for deduction under Section 80EEA: The deduction of Rs 1.5 lakh in a financial year is available under section 80EEA . Deduction on payment of interest on a housing loan was as per Budget 2019. This deduction is available over and above on the limit mentioned in section 80EE i.e. Rs 2 lakh deduction available on the interest payment on housing loan subject to some conditions:

- Housing loan must be taken from a financial institution for buying a residential house property

- The home loan must be taken between April 1, 2021 and March 31, 2022.

- Stamp duty value of the house property should not more than Rs 45 lakhs

- The individual taxpayer should not be eligible to claim deduction under the existing Section 80EE.

- The taxpayer should not own any residential house property.

It has been proposed to extend the said date for sanction of such housing loan by one year to 31-03-2022.

- Extension in the time-limit for deduction to rental housing projects(section80-IBA): The section provides the deduction of an amount equal to 100% of the profits and gains derived by an assessee from the business of developing and building affordable housing project approved on or before 31-03-2021. This date has been proposed to be extended to 31-03-2022.

- Extension in the Due date for the incorporation of start-up co.( Section 80-IAC) : A start-up is eligible for deduction under section 80-IAC if it satisfies some conditions. One of the conditions provide that it should be incorporated between 01-04-2016 and 31-03-2021. It has been proposes to extend the outer date of incorporation to 31-03-2022.

ASSESMENTS AND APPEAL

- Time limit for reopening of cases :Finance Bill ,2021 reduced the time limit for reopening of income tax assessment cases to 3 years from 6 years, while for serious tax fraud cases where concealment is of Rs 50 lakh or more it would be 10 years from the end of relevant assessment year.

- Reduction of time limit for completion of the assessment proceedings: Prior to budget ,assessment under section 143 and 144 had to be completed within one year from the end of financial year in which the return of income was filed. Finance Bill 2021, proposes the time limit for completion of assessment shall be 9 months from the assessment year in which income was first assessable.

- Faceless scheme for Income Tax Appellate Tribunal (ITAT) appeal: Income Tax Appellate Tribunal will become faceless and the Authority for Advance Rulings will be replaced to expedite tax cases. All communication between the tribunal and the appellant will be through electronic mode. Video-conferencing will be used for personal hearing .

- Constitution of Dispute Resolution committee(DRC) for small and medium taxpayers: The Union Budget, 2021 is proposed for setting up of Dispute Resolution Committee (DRC). Taxpayers having a taxable income of up to Rs. 50 lakh and disputed income of up to Rs. 10 lakh shall be eligible to approach the DSC. The assessee would have an option to opt or not to opt for the dispute resolution through the DRC.

- Discontinuance of Income-tax Settlement Commission(ITSC):It is proposed to discontinue Income-tax Settlement Commission (ITSC) and to constitute Interim Board of settlement for pending cases with effect from 01-02-2021.The Central Government is empowered to notify a scheme for settlement in respect of pending applications by the Interim Board.

- Constitution of the Board for Advance Ruling : A Board of Advance Ruling is proposed to be constituted ,to provide an alternative method of providing advance ruling which can give rulings to taxpayers promptly. The Authority for Advance Rulings shall cease to operate with effect from such date, as may be notified by the Central Government in the Official Gazette.

OTHER PROVISIONS :

- No Interest for any deficit in the advance tax liability due to dividend income: If any shortfall in the advance tax instalment or the failure to pay the same due to dividend income, it has been proposed that no interest under section 234C shall be charged except the assessee has paid full tax in subsequent advance tax instalments

- Relief from interest on refund of the excess sum paid under IDS: The Union Budget 2021, has been proposed that such excess amount of tax , surcharge, or penalty paid in pursuance of a declaration made under the Scheme shall be refundable to the specified class of persons without payment of any interest.