Discovering a manner to appropriate resource for searching a structured approach, and that’s where trust registration steps in. In a land of Rajasthan, which is rich in tradition and culture, trust registration under the Indian Trust Act, 1882, presents a roadway to realize a dream of legal norms. This article will help you all to provide a guidance in Trust registration in Rajasthan, their necessary criteria, documents required and key features of Trust registration in Rajasthan.

| Table of Content |

Know about Trust Registration

Trust registration refers to the legal process of officially establishing a trust entity by registering it with the appropriate government authorities. A trust is a legal arrangement where one party, known as the settlor or grantor, transfers ownership of assets to another party, known as the trustee, for the benefit of a third party, known as the beneficiary. The trustee holds and manages the assets in accordance with the terms and objectives set out in the trust deed.

Trust registration is important because it provides legal recognition and validity to the trust. Once registered, the trust becomes a distinct legal entity, separate from its trustees and beneficiaries. This registration process ensures transparency, accountability, and compliance with applicable laws and regulations. It also offers certain tax benefits and legal protections.

The process of trust registration typically involves preparing a trust deed that outlines the objectives, rules, and regulations of the trust. This document is then submitted to the relevant government authority, usually the local Sub-Registrar’s Office, along with required documents and fees. The authorities review the trust deed, verify the provided information, and if everything is in order, they issue a registration number.

Key features of Trust Registration

Trust registration involves several key features that define the legal entity and its operation. Here are some important features of trust registration:

- Legal Entity: Once a trust is registered, it becomes a distinct legal entity separate from its trustees and beneficiaries. This means the trust can own property, enter into contracts, and sue or be sued in its own name.

- Trust Deed: The trust deed is a foundational document that outlines the trust’s objectives, rules, regulations, and the roles and responsibilities of the trustees and beneficiaries. The trust deed is a legally binding agreement that governs the trust’s operation.

- Settlor: The individual who establishes the trust by transferring assets to the trustees is known as the settlor or grantor. The settlor’s intention and wishes, as documented in the trust deed, guide the trust’s activities.

- Trustees: Trustees are individuals appointed to manage and administer the trust’s assets and affairs. They have a fiduciary duty to act in the best interests of the beneficiaries and according to the terms of the trust deed.

- Beneficiaries: Beneficiaries are individuals or groups who are intended to benefit from the trust’s objectives. The trust deed outlines the rights and entitlements of beneficiaries.

- Clear Objectives: The trust’s objectives must be clearly defined and lawful. The trust is established to fulfil these objectives, which can be charitable, religious, educational, social, or for any other lawful purpose.

- Property Transfer: A trust involves the transfer of property (money, real estate, securities, etc.) from the settlor to the trustees for the benefit of the beneficiaries. The ownership of the property is transferred to the trustees, who hold it in trust.

- Beneficiary Rights: Beneficiaries have certain rights, which may include the right to receive benefits according to the trust’s objectives, the right to information about the trust’s activities, and the right to challenge any actions that breach the terms of the trust.

- Perpetual Existence: A trust can have perpetual existence, meaning it can continue to exist beyond the lifetimes of its original founders, as long as it continues to fulfil its objectives and the terms of the trust deed.

- Accountability and Reporting: Trustees have a duty to manage the trust’s assets responsibly and transparently. They often need to provide periodic reports to beneficiaries and authorities about the trust’s financial and operational activities.

- Tax Benefits: Depending on the trust’s objectives and the relevant tax laws, registered trusts can often enjoy certain tax benefits or exemptions.

- Registration: Trust registration involves submitting the trust deed and necessary documents to the appropriate government authority for legal recognition. The registration process provides validity and legal standing to the trust.

Necessary Criteria for Trust Registration in Rajasthan

The eligibility criteria for trust registration in Rajasthan are:

- Intention to Create a Trust: The primary eligibility criterion is the genuine intention to create a trust for a lawful purpose. The trust’s objectives and purposes must be legal and not contrary to public policy.

- Trustees: You need to have at least two individuals who are willing to act as trustees of the trust. These individuals should be of sound mind, not disqualified by law, and willing to assume the responsibilities of managing the trust’s affairs.

- Beneficiaries: The trust must have identifiable beneficiaries or a clear class of beneficiaries who will benefit from the trust’s objectives. The beneficiaries can be individuals, groups, or entities, and their identity and benefit should be clearly defined in the trust deed.

- Trust Deed: The trust deed is a crucial document that outlines the objectives, rules, and regulations of the trust. The trust deed must be properly drafted, signed by the settlor and trustees, and it should include essential details such as the name of the trust, its objectives, details of the trustees, and the beneficiaries.

- Property: The trust must involve the transfer of property (movable or immovable) to the trustees for the benefit of the beneficiaries. The property’s details and ownership transfer should be explicitly mentioned in the trust deed.

- Compliance with Stamp Duty and Registration Laws: The trust deed must be properly stamped according to the applicable stamp duty laws and should be registered with the local Sub-Registrar’s Office. Proper adherence to stamp duty and registration requirements is crucial for the trust’s legal validity.

- No Religious or Charitable Disabilities: There are certain restrictions on creating a trust for religious or charitable purposes under Section 20 of the Indian Trust Act, 1882. Ensure that the trust’s objectives comply with these restrictions.

- Compliance with Local Laws: Be aware of any specific state laws or regulations related to trust registration in Rajasthan. Requirements can vary from state to state, so ensure that you meet any additional requirements specific to Rajasthan.

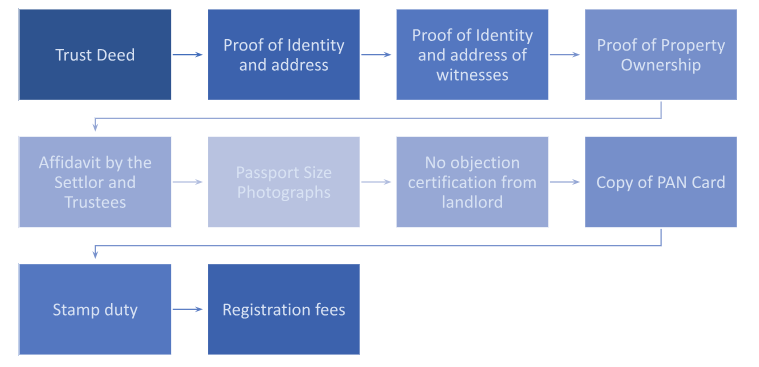

Documents needed at the time of Trust Registration in Rajasthan

Here are the general documents that are typically needed for trust registration:

How to get Trust Registration in Registration in Rajasthan under the Indian Trust Act, 1882?

To get a trust registered in Rajasthan under the Indian Trust Act, 1882, you need to follow a series of steps. Here’s a general outline of the process:

-

- Step 1: Prepare the Trust Deed: A trust deed is a legal document that outlines the objectives, rules, and regulations of the trust. It must include details such as the name of the trust, its objectives, details of the trustees, and the beneficiaries. The deed must be drafted carefully to ensure compliance with the law.

- Step 2: Choose Trustees Select: trustworthy individuals who will act as trustees of the trust. Trustees are responsible for managing and administering the trust according to its objectives.

- Step 3: Visit the Sub-Registrar’s Office

You need to visit the local Sub-Registrar’s Office that has jurisdiction over the area where the trust is located. Here’s what you’ll need to do:

- Submit Application: Submit an application for the registration of the trust along with the trust deed and all necessary documents.

- Pay Fees: Pay the required registration fees. The fees are generally calculated based on the valuation of the trust property mentioned in the deed.

- Verification and Documents: The Sub-Registrar will verify the trust deed and the provided documents. They might ask for any additional documents or information if required.

- Witnesses: The trust deed must be signed by two witnesses in the presence of the Sub-Registrar.

- Step 4: Registration of Trust: Once the Sub-Registrar is satisfied with the trust deed and all requirements are met, the trust deed will be registered, and a registration number will be provided. The registration process provides legal validity to the trust deed.

-

- Step 5: Stamp Duty Ensure that the trust deed is properly stamped. Stamp duty rates vary based on the valuation of the trust property and the provisions of the state Stamp Act.

- Step 6: Obtain a Copy of the Registered Trust Deed: After registration, you will receive a copy of the registered trust deed. This is an important document that proves the existence and legitimacy of the trust.

- Step 7: Apply for PAN and Bank Account: You will need to apply for a Permanent Account Number (PAN) for the trust and open a bank account in the name of the trust to manage its finances.

Takeaway

In concluding this exploration of trust registration in Rajasthan, we find ourselves at the intersection of purpose and legality. The process of registering a trust isn’t just a bureaucratic requirement; it’s a gateway to transforming aspirations into actions that shape communities and lives. Rajasthan’s rich cultural heritage and spirit of giving blend seamlessly with the framework of the Indian Trust Act, 1882, offering a platform for visionary individuals and organizations to bring about meaningful change.