The Goods and Services Tax (GST) Composition Scheme is a concept of simplified taxation, which is introduced by the Indian government to relieve the compliance burden on small businesses. Under GST Composition Scheme, several eligible enterprises can attain benefits like a simplified filing process, reduced tax rates, etc. This article, main aim is to provide thorough knowledge about GST Composition Scheme, its features along with benefits, and GST Composition Scheme rules.

|

Table of Content |

Short note on GST Composition Scheme

The GST Composition Scheme is designed to reduce the compliance burden for small businesses by offering them certain benefits and relaxed tax obligations. Under the GST Composition Scheme, eligible businesses with a turnover below a specified threshold can opt for a simplified tax structure. These businesses are known as composition taxpayers. They pay taxes at a lower rate compared to regular taxpayers and have simplified filing procedures.

The scheme provides several advantages to composition taxpayers. They enjoy reduced tax rates, typically lower than the regular GST rates applicable to other businesses. Composition taxpayers also have simplified compliance requirements, such as filing quarterly returns instead of monthly returns. This helps to streamline the overall tax filing process, reducing the administrative burden.

Additionally, businesses availing of the composition scheme have limited documentation requirements, which means they do not need to maintain detailed records or follow complex accounting procedures. This simplifies their record-keeping and reduces administrative costs.

However, there are certain limitations and restrictions for businesses opting for the GST Composition Scheme. They are not eligible to claim input tax credit on purchases, meaning they cannot offset the GST paid on their inputs against the GST collected on their sales. Composition taxpayers also have restrictions on the interstate supply of goods or services and are unable to sell goods through e-commerce platforms.

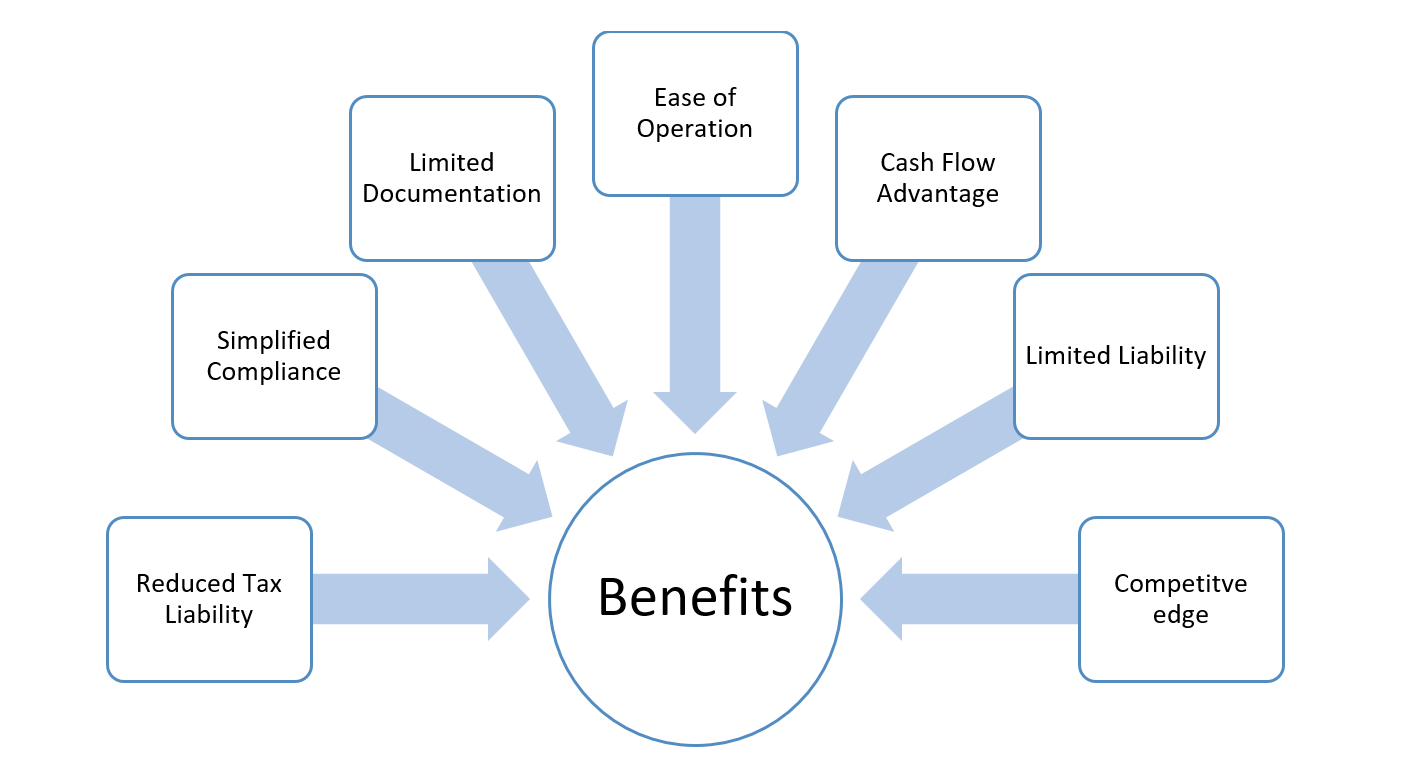

Benefits of the GST Composition Scheme

The GST Composition Scheme offers several benefits to eligible businesses. Here are the key advantages of the scheme:

- Reduced Tax Liability: One of the primary benefits of the composition scheme is the lower tax liability for small businesses. Composition taxpayers pay taxes at a lower rate compared to regular taxpayers, which helps in reducing the overall tax burden.

- Simplified Compliance: The composition scheme simplifies the compliance requirements for small businesses. Instead of filing monthly returns, composition taxpayers only need to file quarterly returns (GSTR-4), reducing the frequency of tax filings. This reduces the administrative burden and compliance costs associated with tax filings and record-keeping.

- Limited Documentation: Under the composition scheme, businesses have reduced documentation requirements compared to regular taxpayers. They are not required to maintain detailed records of every transaction like invoices and outward supplies. This simplifies the record-keeping process, saves time, and reduces paperwork.

- Ease of Operations: By opting for the composition scheme, small businesses can focus more on their core operations rather than on complex tax compliance procedures. The simplified tax structure and reduced compliance obligations free up resources and allow businesses to concentrate on their growth and expansion.

- Cash Flow Advantage: Composition taxpayers generally experience improved cash flow management. As they pay taxes at a lower rate, they have more working capital available for business operations and investment purposes.

- Limited Liability: Businesses registered under the composition scheme are not required to collect taxes from their customers or issue tax invoices. This reduces the burden of tax-related responsibilities, such as maintaining extensive tax records and handling complex invoicing processes.

- Competitive Edge: The composition scheme can provide a competitive advantage to small businesses in the market. With lower tax rates, they can offer competitive prices to customers, which may attract more sales and business opportunities.

Rules for GST Composition Scheme

The Composition Scheme under GST is governed by certain rules and regulations that businesses must adhere to. Here is the key to the GST Composition Scheme rules:

- Opting into the Scheme: Eligible businesses can choose to opt for the composition scheme at the beginning of the financial year. They need to submit the necessary forms, such as GST CMP-02, to the tax authorities to enrol in the scheme.

- Tax Rates: Composition taxpayers pay taxes at reduced rates compared to regular taxpayers.

- For manufacturers and traders, the tax rate is typically 1% of the turnover (0.5% CGST and 0.5% SGST/UTGST). For restaurants (not serving alcohol), the tax rate is usually 5% of the turnover (2.5% CGST and 2.5% SGST/UTGST).

- Quarterly Returns: Composition taxpayers are required to file quarterly returns (GSTR-4) instead of monthly returns. The due date for filing GSTR-4 is within 18 days after the end of the quarter.

- Limited Input Tax Credit (ITC): Composition taxpayers are not eligible to claim input tax credit on their purchases. They cannot offset the GST paid on inputs against the GST collected on sales.

- Restrictions on Inter-State Supply: Businesses registered under the composition scheme are not allowed to supply goods or services outside their state. They are restricted to intra-state transactions only.

- Compliance Obligations: Composition taxpayers must mention the words “Composition Taxable Person” on their invoices or bills of supply. They are not required to issue tax invoices or charge GST separately on their supplies. They are not allowed to collect GST from customers and cannot avail of the benefits of input tax credit.

- Exit from the Scheme: A business can voluntarily exit the composition scheme if it no longer meets the eligibility criteria or wishes to switch to the regular tax regime. To exit the scheme, the business needs to apply Form GST CMP-04.

Tutorial for filing an application in Form GST CMP-04

Takeaway

Through the above-mentioned information, we can say that by opting for the GST composition scheme, businesses can take several benefits. It provides a cash flow advantage, eases operational burdens, and allows businesses to focus on their core operations. However, businesses need to carefully evaluate their eligibility and consider the limitations of the scheme. Composition taxpayers are not eligible for input tax credits, have restrictions on interstate supply, and cannot sell goods through e-commerce platforms. These factors may impact businesses that heavily rely on input tax credits or have a wider market reach.