| Table of Content |

An EXCEL based offline tool has been provided on GST(Goods and services taxes) portal for composition taxpayers to prepare their GSTR-4 Annual Return.

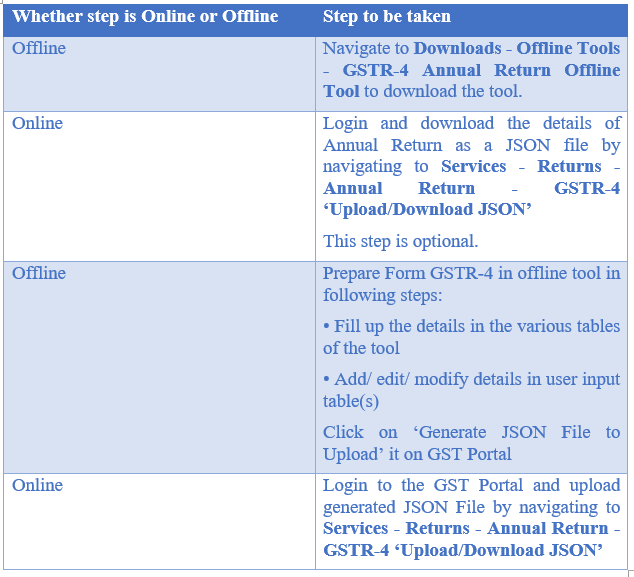

Steps to use the offline tool:

Details which can be entered in Offline Tool:

Users can enter details in various Tables like Table 3 (a) (Aggregate turnover for previous FY), 4A (Inward supplies from registered suppliers), 4B & 4C (Inward supplies received from a registered/ unregistered supplier on RCM basis), 4D (Import of services) & 6 (only Row 12 to 16: Tax rate wise details of outward supplies during the year (Net of advances, credit/debit notes/adjustments)).

Details which are un-editable in Offline Tool:

Details in Table 5 (Summary of self-assessed liability as per FORM GST CMP-08), 6 (Row 1 to 11: Tax liability on RCM basis auto-populated from Table 4B, 4C & 4D) & 7 (TDS/TCS Credit received) are non-editable.

Some important points related to using offline tool are:

- Click on the ‘Validate’ button, to validate data in each worksheet in the offline tool, after all details have been filled in that sheet.

- In case of validation failure of details on uploading a JSON file, an error file will be generated with status as ‘Processed with Error’. This file can be downloaded, open in offline too, corrected and can be uploaded again by creating a JSON file again.

- Upon upload of this JSON file, these records will get incrementally added to the records uploaded earlier. If there are pre-existing records on the Portal, against the same PAN(permanent account number)/GSTIN, those details will get replaced/updated.

Payment of Taxes can be made only online after logging into the GST Portal.