Winding up of a Limited Liability Partnership (LLP) refers to the process of closing down and dissolving the LLP. The procedure for Winding up of LLP involves liquidating the assets, settling the liabilities, and distributing any remaining funds among the partners. The procedure for winding up of an LLP can be initiated voluntarily by the partners or can be ordered by a court in case of insolvency or other specified circumstances. The purpose of winding up is to bring an orderly end to the LLP’s affairs and terminate its legal existence. It is essential to follow the prescribed procedures and comply with legal requirements to ensure a smooth and legally compliant dissolution of the LLP.

|

Table of Contents |

Definition and significance of winding up an LLP

Winding up an LLP refers to the process of formally closing down and dissolving the LLP. It involves settling the LLP’s debts, liquidating its assets, and distributing any remaining funds among the partners. The significance of winding up an LLP lies in the proper resolution of its financial and legal affairs. It allows for the orderly conclusion of the LLP’s operations, ensuring that all creditors are paid and partners’ interests are addressed. Winding up is essential to bring finality to the LLP’s existence, protect the interests of stakeholders, and comply with legal requirements governing the closure of business entities.

Preparing for Winding up

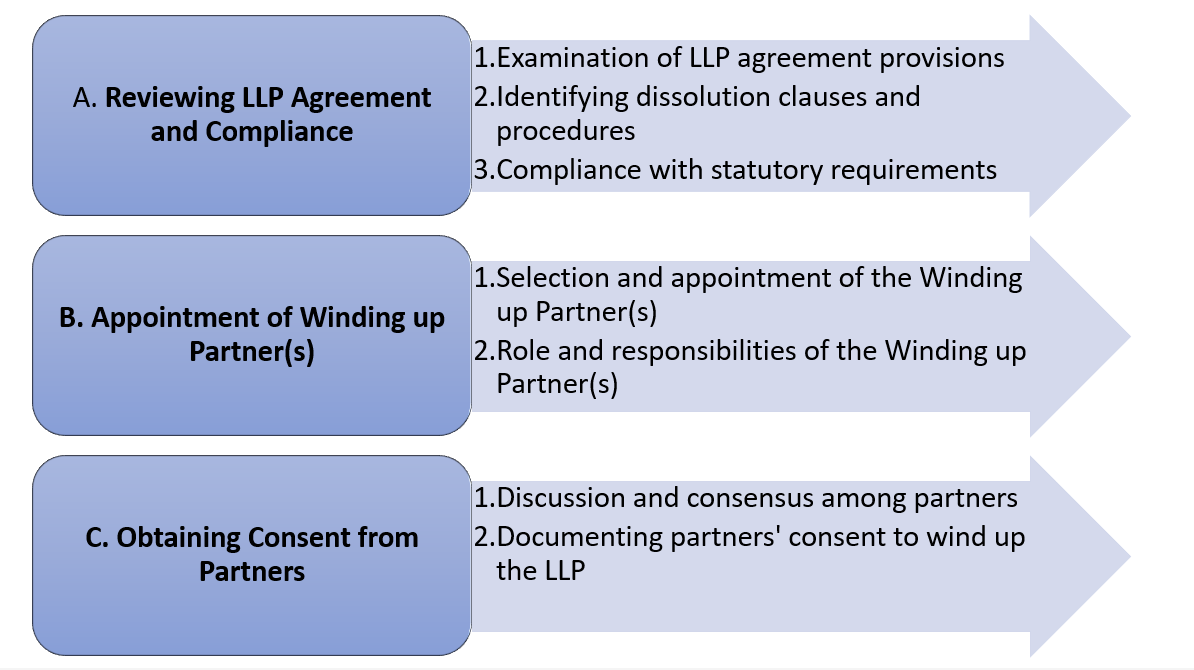

Preparing for the LLP winding up process involves several important steps. Here is an expanded outline covering the additional subtopics:

- Reviewing LLP Agreement and Compliance

- Examination of LLP agreement provisions

- Thoroughly review the LLP agreement to understand its terms and conditions.

- Identify clauses related to winding up, dissolution, and termination.

- Take note of any specific procedures or requirements outlined in the agreement.

- Identifying dissolution clauses and procedures

- Identify clauses within the LLP agreement that pertain to dissolution.

- Understand the procedures specified for initiating the winding up process.

- Note any conditions or prerequisites for commencing the winding up.

- Compliance with statutory requirements

- Ensure compliance with legal and regulatory requirements for winding up an LLP.

- Review relevant legislation and guidelines to understand the obligations.

- Take necessary steps to fulfil reporting, filing, and disclosure requirements.

- Appointment of Winding up Partner(s)

- Selection and appointment of the Winding up Partner(s)

- Select partners or professionals suitable for taking on the winding up responsibilities.

- Consider their experience, knowledge, and availability.

- Determine the number of winding-up partners required per the LLP agreement and legal requirements.

- Role and responsibilities of the Winding up Partner(s)

- Define the responsibilities of the winding up partner(s).

- Communicate and document their roles in managing the winding-up process.

- Ensure they understand their legal obligations and duties as per the LLP agreement and statutory requirements.

- Obtaining Consent from Partners

- Discussion and consensus among partners

- Engage partners in discussions regarding the decision to wind up the LLP.

- Provide information on the reasons, implications, and potential outcomes.

- Encourage open dialogue and strive for consensus among the partners.

- Documenting partners’ consent to wind up the LLP

- Prepare a written record of the partners’ consent to initiate the winding-up process.

- Obtain signatures or acknowledgements from each partner.

- Keep the documented consent securely as a legal record.

Statement of Affairs and Declaration

Once the decision has been made to wind up an LLP, the next step in the process involves preparing the Statement of Affairs and Declaration. This step is essential in assessing the financial position of the LLP and providing transparency to all stakeholders involved. Here’s an outline of the key elements related to the Statement of Affairs and Declaration:

- Preparation of Statement of Affairs

- Valuation of LLP’s assets and liabilities

- Conduct a comprehensive assessment of all the assets owned by the LLP, including property, investments, inventory, and intellectual property.

- Determine the fair market value of each asset based on its current condition and market conditions.

- Identify and calculate all outstanding liabilities, such as debts, loans, and obligations to creditors, employees, and suppliers.

- Creation of a comprehensive Statement of Affairs

- Compile the gathered information to prepare the Statement of Affairs.

- Structure the statement to present a clear and accurate overview of the LLP’s financial position at the time of winding up.

- Include details of assets, liabilities, and the estimated value available for distribution among the partners.

- Declaration of Solvency

- Preparation and signing of a Declaration of Solvency

- The Declaration of Solvency affirms that the LLP is solvent and can pay off its debts within a specific period (usually 12 months).

- Prepare the Declaration of Solvency, which includes a statement confirming that the LLP can fulfill all its obligations.

- Filing the Declaration with the Registrar of LLP

- Submit the Declaration of Solvency to the Registrar of LLP, along with the required forms and fees.

- Ensure that the filing is done within the prescribed timeline, as per the applicable regulations.

Creditors’ Meeting and Settlement

As part of the winding up process of an LLP, conducting a Creditors’ Meeting and Settlement is crucial to address outstanding liabilities and ensure fair treatment of creditors. Convening a Creditors’ Meeting allows the LLP to communicate with its creditors, providing an opportunity for them to present their claims. Notices are issued to creditors, inviting them to attend the meeting. During the meeting, discussions take place regarding the settlement of outstanding debts and liabilities. The LLP aims to reach an agreement with the creditors on the settlement terms, including the amount to be paid, the timeline for payment, and any potential compromises. Obtaining clearance from creditors ensures a fair and orderly resolution of outstanding financial obligations before proceeding with the winding up process.

Liquidation and Distribution of Assets

Liquidation and Distribution of Assets in the winding up process of an LLP involves the orderly sale, transfer, or disposal of assets and the subsequent distribution of proceeds or remaining funds to the partners. Here are the key points regarding this step:

- Realization and Liquidation of Assets:

- Identify and catalog all assets of the LLP, including property, inventory, investments, and intellectual property.

- Determine the most appropriate method for liquidating each asset, such as selling through auctions, private sales, or transferring ownership.

- Maintain proper documentation of asset liquidation, including sale agreements, transfer deeds, and records of funds received.

- Distribution of Assets:

- Prioritize the repayment of any outstanding debts owed by the LLP, including liabilities to creditors, employees, and suppliers.

- Allocate funds to repay partners’ capital contributions according to the agreed-upon terms specified in the LLP agreement.

- Distribute any remaining funds or assets among the partners based on their profit-sharing ratios or as outlined in the LLP agreement.

- Document the distribution of assets and funds through receipts, acknowledgements, and partnership accounts.

- Compliance with Legal Requirements:

- Ensure compliance with applicable tax laws, reporting requirements, and asset liquidation and distribution regulations.

- Seek professional advice to navigate complex legal and financial considerations, ensuring adherence to legal obligations during the process.

Filing Closure Documents

Filing Closure Documents is a crucial step in the winding up process of an LLP, ensuring compliance with legal requirements and notifying relevant authorities of the LLP’s closure. Here are the key points regarding this step:

- Preparation of Final Accounts: Complete the final accounts and financial statements, reflecting the LLP’s financial position at the time of winding up.

- Finalization of Tax and Audit Matters: Settle any pending tax liabilities and complete necessary tax filings. Ensure all audit matters are resolved and financial records are updated.

- Filing Closure Documents with the Registrar: Submit the final accounts, financial statements, and other required documents to the Registrar of LLP, following the prescribed format and timeline.

- Obtaining Closure Certificate: Await the Registrar’s review and approval. Once satisfied, the Registrar will issue a closure certificate, confirming the LLP’s dissolution.

Publication and Dissolution

Publication and Dissolution are the final steps in winding up an LLP, marking the official conclusion of its operations. Here are the key points regarding this step:

- Publication of Notice: As required by law, publish a notice in an official gazette and local newspapers announcing the LLP’s intention to dissolve. Comply with specific publication requirements and timelines.

- Dissolution of LLP: Obtain a dissolution certificate from the Registrar, signifying the legal termination of the LLP. Cease all business activities and operations of the LLP.

Conclusion

The winding up process of an LLP involves several crucial steps to ensure a smooth and legally compliant closure. From reviewing the LLP agreement and appointing winding-up partners to obtain consent from partners and preparing closure documents, each stage plays a significant role in facilitating a successful winding-up process. By following the proper procedures and complying with statutory requirements, an LLP can navigate through the winding up process effectively, addressing outstanding liabilities, distributing assets, and fulfilling legal obligations. Transparency, communication, and adherence to regulatory guidelines are essential throughout the process.