| Content: |

Introduction

Before anyone imagines this as a trust that we have in our friends, God, parents and the loved ones, let me tell you that the one we are taking here lays its roots in legal and business terminology. Yes the one you get to hear in many Bollywood movies and Ekta Kapoor’s serials

A trust is not a separate legal entity where it carriers out the business on part of the trust members based on a trust deed. It can be an individual or corporate. The trustee is legally bound for the debts of trust and can use the former’s assets to meet it out. However, in case of shortfall the trustee is liable to make up for the same.

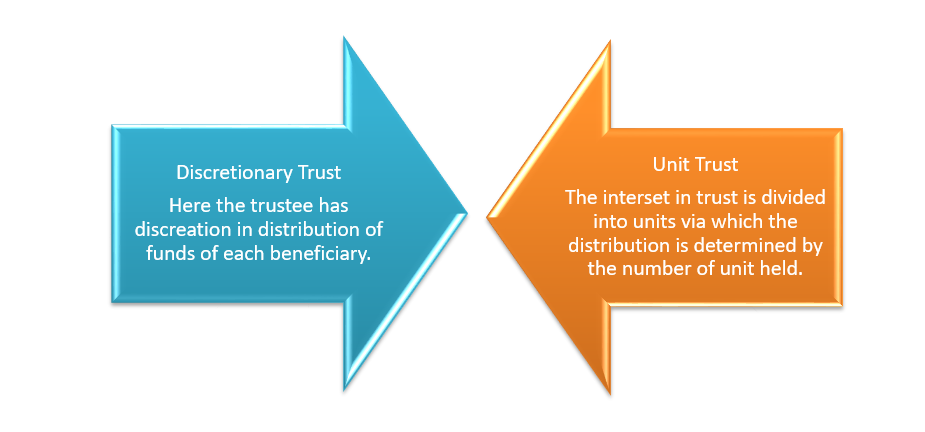

There are two types of trust:

Trust company

A trust company is a legal entity that plays as a fiduciary, agent, or trustee on behalf of a person or business for the task of administration, management, and the transfer of assets to the beneficial party. The trust company plays as a custodian for trusts, estates, custodial arrangements, asset management, stock transfer, beneficial ownership registration, and other corresponding arrangements.

Work of a trust company

Though most of the times the individuals are assigned as a trustee but the trust company can also act in the same place. A trust company does not own any asset its customers assign to its management, while reserving the rights and duty to take care of assets on behalf of other parties. The company is usually a division or a sister company of commercial bank. The trust companies offer a variety of services, including the managerial activities.

- Wealth management services, including the investment management and wealth preservation so that a client’s future generations have the funds when needed.

- Asset management services, like bill payment, cheque writing etc.

- Brokerage services

- Building financial plans

- Estate planning matters

- Successor trustee

Pros or Benefits of trust

There are some advantages of trust:

- Trust usually reduces the liability especially in case of corporate trust.

- The assets are well protected and secured.

- There is more flexibility of asset and income distribution.

- A trust always works for benefits of its clients as the relationship is fiduciary with them, thus providing the best investment decisions.

- The service like the one of investment management is helpful for the ones who are novice in the financial markets.

- These are best for the persons who do not want to engage in routine business activities.

- They are often acting as a third party wherein there are estate or property disputes in the family.

Cons or Disadvantages of a trust

There are some disadvantages of trust:

- Expensive in terms of establishment and administration.

- Difficult to alter once pen down especially wherein children are involved.

- The retained profits will be liable to penalty tax rates.

- Losses cannot be distributed.

Tax requirement

In case of trust, it is not responsible for paying tax. Instead the trustee must apply for tax file number (TFN) and file an annual trust return. Here, the people entitled to receive the trust net income are liable to be assessed. The income tax return of Charitable Trusts must be filed using ITR 5 or ITR 7. In case the Trust is required to file an income tax return due to taxable income being in excess of the basic exemption limit, then ITR 5 will require to be filed.