In a world where financial services play a significant role in economic growth and social development, cooperative societies have emerged as a powerful mechanism for fostering financial inclusion and collective empowerment. Among them, Multi State Credit Cooperative Societies stand out as a unique model that exceeds geographical boundaries to cater to the diverse requirements of members across multiple states. The process for a Multi-State Credit Cooperative Society registration is a crucial step towards formalizing its operations and setting a legal framework for its functioning. This article offers a comprehensive overview of the Multi-State Credit Cooperative Society registration process, highlighting its significance and the key considerations involved.

What do you mean by Multi State Credit Cooperative Society?

A multi-state credit cooperative society is a type of cooperative society that operates across multiple states or regions within a country. It is formed by a group of individuals who come together to pool their resources and promote economic and social interests through cooperative efforts.

The main objective of a multi-state credit cooperative society is to provide financial services and credit facilities to its members. These societies primarily focus on extending credit, savings, and other financial services to their members, who are typically individuals or small businesses. The members of the society contribute funds and participate in the decision-making process of the cooperative.

Multi-state credit cooperative societies are regulated by cooperative laws and regulations at both the national and state levels, depending on the country’s legal framework. The registration and governance of these societies are typically overseen by a central cooperative authority or registrar, along with regional cooperative departments in each state or region where the society operates.

As the name suggests, the distinguishing feature of a multi-state credit cooperative society is its ability to operate and provide services across multiple states or regions. This allows the society to cater to a larger membership base and extend its reach beyond a single geographical area. The cooperative society must comply with the laws and regulations of each state or region in which it operates.

Benefits of Multi-State Credit Cooperative Society Registration

Here are some key benefits of Multi State Credit Cooperative Society registration:

- Legitimacy and Credibility: Registration provides legal recognition to the cooperative society, establishing its legitimacy and credibility in the eyes of its members, stakeholders, and the public. It assures members that the society operates within a regulated framework and adheres to cooperative principles, fostering trust and confidence.

- Expansion and Growth Opportunities: Registration as a multi-state society opens doors for expansion and growth into new regions and markets. It allows society to tap into diverse economic and social landscapes, catering to the specific needs and demands of different states. This expansion potential contributes to the sustainable growth and long-term viability of the cooperative society.

- Access to Government Support and Funding: Registered multi-state credit cooperative societies may be eligible to access government schemes, programs, and funding dedicated to supporting cooperative initiatives. These resources can facilitate the cooperative’s growth, provide technical assistance, and enhance its capacity to deliver impactful financial

- Representation and Advocacy: Registered societies often have a stronger platform for representation and advocacy at the government and regulatory levels. They can voice the interests and concerns of their members and actively participate in policy discussions related to cooperative development, financial inclusion, and socio-economic empowerment.

- Networking and Collaboration: Being a registered multi-state credit cooperative society facilitates networking and collaboration opportunities with other cooperative organizations, financial institutions, and stakeholders. These partnerships can result in knowledge-sharing, resource pooling, and collective efforts towards common goals, further enhancing the society’s impact.

Eligibility Criteria for Multi-State Credit Cooperative Society Registration

Here are some common eligibility criteria for Multi Credit Cooperative Society Registration:

- Minimum Number of Members: Typically, there is a minimum requirement for the number of members needed to form a multi-state credit cooperative society.

- Area of Operation: A multi-state credit cooperative society is expected to operate across multiple states or regions within the country. Therefore, it should have a clear plan and intention to extend its activities beyond a single geographical area.

- Common Bond: The members of the society should share a common bond, which may include common economic, social, or professional interests. This bond helps to define the purpose and scope of the cooperative society.

- Financial Capability: The society should have adequate financial resources to carry out its activities and fulfil its objectives. The financial capability may be assessed based on the initial capital contribution from the members or other financial resources available to the society.

- Management and Governance: The society should have a proper management structure in place, including a board of directors or governing body responsible for managing its affairs. The management team should have individuals with the necessary qualifications and experience to handle the financial operations of the society.

- Compliance with Cooperative Laws and Regulations: The society must comply with the cooperative laws, regulations, and guidelines set forth by the regulatory authorities overseeing cooperative societies. This includes adherence to reporting requirements, financial audits, and other legal obligations.

- No Adverse History: The members and key office bearers of the society should have a clean track record, without any adverse history or involvement in fraudulent activities or financial irregularities.

Necessary documents required for Multi State Credit Cooperative Society Registration

The necessary documents required for multi-state credit cooperative society registration:

- Application Form: A completed application form provided by the cooperative department or registrar, containing relevant information about the society, its members, and its objectives.

- Memorandum of Association (MOA): The MOA is a legal document that outlines the society’s name, registered office address, objectives, rights, and liabilities of the members, and other essential details. It serves as the founding document of the society.

- Article of Association (Rules and Regulations/Bylaws): The society’s rules and regulations, also known as bylaws or articles of association, define the internal governance, membership criteria, rights, and obligations of the members, decision-making processes, and other operational guidelines.

- Address Proof: Documents providing proof of the registered office address of the society, such as a rental agreement, lease agreement, utility bill, or property ownership documents.

- Identity Proof: Identity proof of the members, such as copies of their passports, national identification cards, or other government-issued identification documents.

- Address Proof of Members: Documents providing proof of address of the society’s members, such as utility bills, bank statements, or government-issued address proofs.

- List of Members: A list of all the individuals who are becoming members of the society, including their names, addresses, occupations, and other relevant details.

- Minutes of the General Meeting: Minutes of the general meeting where the decision to form the society was made, along with the election of the board of directors or governing body.

- Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, show the financial position and performance of the society.

- Affidavits and Declarations: Affidavits and declarations signed by the members or office bearers of the society affirm the accuracy and truthfulness of the provided information and documents.

- Bank Account Details: Information regarding the society’s bank account, including the name of the bank, account number, and branch details.

Procedure for Multi-State Credit Cooperative Society Registration

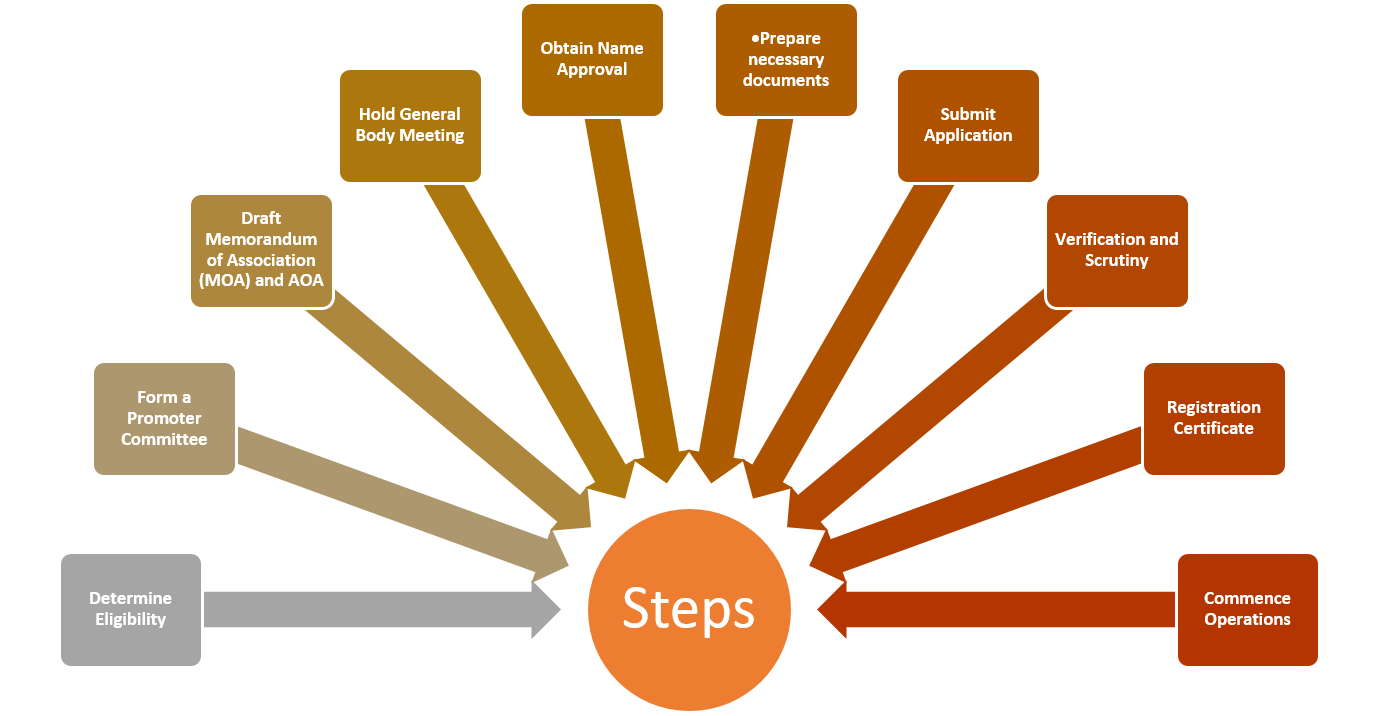

The procedure for Multi State Credit Cooperative Society registration is as follows:

- Determine Eligibility: Review the eligibility criteria for Multi State Credit Cooperative Society registration.

- Form a Promoter Committee: Assemble a group of individuals who will serve as the initial members and promoters of the society. This committee will be responsible for initiating the registration process, preparing the necessary documents, and overseeing the society’s formation.

- Draft Memorandum of Association (MOA) and Article of Association (AOA): Prepare the Memorandum of Association (MOA) and AOA (also known as bylaws) of the society. These documents outline the name and objectives of the society, membership criteria, governance structure, decision-making processes, and other operational guidelines.

- Hold General Body Meeting: Conduct a general body meeting of the promoter committee to discuss and finalize the MOA, Rules & Regulations, and other important matters related to the society’s formation. Obtain the consent and approval of the members for the society’s registration.

- Obtain Name Approval: Submit an application to the appropriate cooperative department or registrar for the approval of the society’s name. The name should comply with the naming guidelines specified by the regulatory authority.

- Prepare necessary documents

- Submit Application: Submit the completed application form along with the required documents to the cooperative department or registrar. Pay the applicable registration fees as per the prescribed guidelines.

- Verification and Scrutiny: The cooperative department or registrar will review the submitted documents and conduct a verification and scrutiny process. This may involve checking the compliance of the society with the cooperative laws and regulations and assessing the eligibility of the members.

- Registration Certificate: If all the requirements are met and the documents are found to be in order, the cooperative department or registrar will issue a registration certificate for the Multi State Credit Cooperative Society.

- Commence Operations: Once the society is registered and obtains the registration certificate, it can commence its operations as a Multi-State Credit Cooperative Society. Open a bank account in the society’s name and start providing financial services to the members as per the objectives and provisions outlined in the MOA and AOA.

Takeaway

Through the registration process, these societies demonstrate their commitment to cooperative principles and their dedication to serving the economic and social needs of their members. By pooling resources, providing credit facilities, and fostering mutual assistance, Multi State Credit Cooperative Societies play a vital role in empowering individuals, small businesses, and underserved communities. The registration process not only confers legal status but also brings transparency, accountability, and good governance to the cooperative society’s operations.