Step into the enchanting land of Jammu, where the beauty of nature blends with the melody of traditions. As you embark on your journey through the scenic valleys and historical marvels, there’s one aspect that beckons your attention – the responsible fulfilment of your tax obligations. Just as the picturesque landscapes demand preservation, the financial landscape of Jammu calls for your proactive engagement in filing your Income Tax Return (ITR). Thus, with the glory of Jammu’s mountains and the serenity of its rivers, let’s explore the art of ITR filing in Jammu, where the harmony of compliance and financial well-being intertwines. It ensures your presence in the vibrant tapestry of Jammu’s tax-paying citizens.

Overview of Income Tax Return

An Income Tax Return (ITR) is a document that individuals or entities submit to the tax authorities, such as the Income Tax Department, to report their income earned during a specific financial year and to calculate the tax liability on that income. It is a legal requirement in many countries, including India, for taxpayers to file their income tax returns annually.

The income tax return provides details of various sources of income, such as salary, business income, capital gains, rental income, and interest income, among others. It also includes information about deductions, exemptions, and tax credits that individuals may be eligible for, such as deductions for investments, insurance premiums, and charitable contributions.

The purpose of filing an income tax return is to determine the taxable income of an individual or entity and calculate the tax liability based on the applicable tax rates. By filing the income tax return, taxpayers fulfil their legal obligations and provide the tax authorities with a comprehensive overview of their financial transactions and income sources.

Filing an income tax return also allows taxpayers to claim any tax refunds they may be eligible for if they have paid excess taxes during the financial year through tax deductions or withholding taxes.

Kinds of Income Tax Returns filing Forms in Jammu

The following are some commonly used ITR forms in Jammu:

- ITR-1 (Sahaj): This form is for individuals being residents, having income from salary, one house property, and other sources (excluding income from lottery or horse racing). It is the simplest ITR form and applies to salaried employees and individuals with relatively straightforward income sources.

- ITR-2: This form is for individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession. It applies to individuals with income from salary, house property, capital gains, and other sources, including those with foreign assets or income.

- ITR-3: This form is for individuals and HUFs who have income from a proprietary business or profession. It applies to individuals who are partners in a partnership firm or have income from a profession such as a doctor, lawyer, architect, consultant, etc.

- ITR-4 (Sugam): This form is for individuals, HUFs, and firms (other than LLP) who have opted for the presumptive taxation scheme under Section 44AD, Section 44ADA, or Section 44AE of the Income Tax Act, 1961. It applies to small businesses, professionals, and freelancers with a turnover below a certain threshold.

- ITR-5: This form is for partnerships, LLPs (Limited Liability Partnerships), Association of Persons (AOPs), and Body of Individuals (BOIs). It applies to entities other than individuals and HUFs.

- ITR-6: This IT form is for companies other than those claiming exemptions under Section 11 (income from property held for charitable or religious purposes). It applies to companies that are required to file income tax returns.

- ITR-7: This form is for persons, including companies, who are required to file a return under Section 139(4A), Section 139(4B), Section 139(4C), or Section 139(4D) of the Income Tax Act. It applies to trusts, political parties, institutions, and entities with specific tax obligations.

Who can file Income Tax Returns in Jammu?

In Jammu, the following individuals and entities are generally eligible to file an ITR:

- Individuals: Any resident individual or non-resident Indian (NRI) who qualifies as a resident as per the provisions of the Income Tax Act can file an ITR. This includes salaried employees, self-employed professionals, businessmen, freelancers, pensioners, and individuals with other sources of income.

- Hindu Undivided Family (HUF): A HUF, which is a separate legal entity consisting of members of a Hindu family, can file an ITR. The HUF is taxed separately from its members.

- Partnership Firms: Partnership firms, which are business entities formed by two or more individuals, can file an ITR. The firm is not taxed separately, but the partners are taxed on their share of the firm’s income.

- Companies: Companies, including Private Limited Companies, public limited companies, and One-Person Companies (OPCs), are required to file an ITR. Companies are taxed separately from their shareholders.

- Trusts and Charitable Institutions: Trusts, religious institutions, and charitable organizations registered under Section 12A or 10(23C) of the Income Tax Act, 1961 need to file an ITR.

Eligibility Criteria for Income Tax Return Filing in Jammu

The eligibility criteria for filing an income tax return in Jammu, as per the Income Tax Act of India, may include the following:

- Residential Status: You should be a resident of India or a Non-Resident Indian (NRI) who qualifies as a resident as per the provisions of the Income Tax Act, 1961. The determination of residential status is based on the number of days you have stayed in India during the relevant financial year.

- Age Criteria: Any individual, regardless of age, can file an income tax return if they have taxable income. However, there are certain specific provisions and tax benefits available for senior citizens (60 years or above) and super senior citizens (80 years or above).

- Taxable Income: You need to file an income tax return if your total income exceeds the basic exemption limit specified by the government for a particular financial year. The exemption limit is subject to change and depends on various factors such as age, income sources, and category of taxpayer.

- Multiple Sources of Income: If you have multiple sources of income, such as salary, business income, capital gains, rental income, or income from other sources, and the total income exceeds the basic exemption limit, you are required to file an income tax return.

- Foreign Assets/Income: If you are a resident of India and have any foreign assets or income, or if you are a signing authority in any foreign account, you need to file an income tax return, regardless of the total income.

Documents required for Income Tax Returns filing in Jammu

The documents required for filing an income tax return in Jammu, as per the general guidelines, include the following:

- PAN Card

- Aadhaar Card: Link your Aadhaar card with your PAN card as it is mandatory for filing income tax returns.

- Form 16

- Form 16A

- Form 26AS: Download Form 26AS from the income tax e-filing portal or TRACES (TDS Reconciliation Analysis and Correction Enabling System). Form 26AS provides a consolidated statement of all the taxes deducted on your behalf by employers, banks, or any other deductors.

- Bank Statements

- Rent Reciept

- Investment Proofs

- Other Supporting Documents: Depending on your income sources and deductions, you may need to gather additional documents such as capital gains statements, property documents, loan statements, medical bills, and charity receipts, among others

How to file Income Tax Return in Jammu?

To file an income tax return in Jammu, you need to follow these general steps:

- Gather the required documents:

- Register on the Income Tax Department’s website: Visit the official website of the Income Tax Department of India and create an account if you don’t already have one. You will need your Permanent Account Number (PAN) to register.

- Choose the appropriate ITR form: Select the appropriate Income Tax Return (ITR) form based on your sources of income. For example, if you have only salary income and no business or professional income, you can use ITR-1 (Sahaj) or ITR-2 if you have additional sources of income.

- Fill in the details: Start filling in the required details in the ITR form. Provide your personal information, income details, deductions, and tax calculations as per the guidelines mentioned in the form.

- Validate and generate XML: After entering all the required information, validate the form to ensure accuracy and completeness. Once validated, generate the XML file of the completed form.

- Upload XML on the income tax portal: Log in to your account on the Income Tax Department’s website, navigate to the “e-File” section, and select “Income Tax Return.” Choose the assessment year and upload the XML file you generated in the previous step.

- Verify the return: After uploading the XML file, you will be asked to digitally sign the return using either a digital signature certificate (DSC) or an electronic verification code (EVC). Choose the appropriate option and complete the verification process.

- Acknowledgement receipt: Once your return is successfully filed, you will receive an acknowledgement receipt (ITR-V) on the registered email ID. Download and save this receipt for future reference.

- Send the signed ITR-V: If you did not use a digital signature to verify your return, you need to send the signed ITR-V to the Income Tax Department’s Centralized Processing Centre (CPC) within 120 days of filing. The address for sending the ITR-V will be mentioned in the acknowledgement receipt.

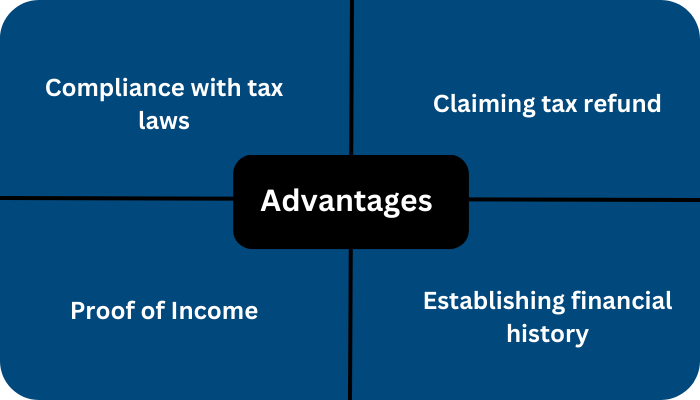

Advantages of Income Tax Return filing in Jammu

Some of the key advantages of filing an ITR include:

Takeaway

Through the above-mentioned information, filing your ITR in Jammu is not just a legal obligation but a vital step towards financial responsibility and contributing to growth. By fulfilling your tax obligations, you not only comply with the tax laws but also unlock a myriad of benefits. As you immerse yourself in the rich culture and heritage of Jammu, let the journey of ITR filing be a seamless part of your financial voyage. Embrace the spirit of Jammu’s vibrant community of tax-paying individuals and entities, and contribute your part towards building a prosperous and inclusive society.