In the realm of taxation, losses are an essential part of businesses and investments. However, the positive aspect is that these losses can often be utilized strategically to offset taxable income and provide financial relief. Income tax set off & carry forward, understanding the provisions of loss set-off and carry forward under the Income Tax Act is vital for prudent tax planning. In this article, we delve into the income tax set off & carry forward the latest provisions, their implications, and how individuals and businesses can leverage them to their advantage.

| Table of Contents |

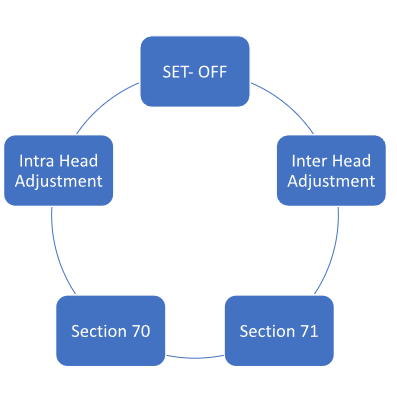

Meaning of Set Off of Losses

The technique of using losses incurred in one source of income to offset taxable income in another is known as the set-off of losses in income tax. By using this approach, taxpayers can lower their overall taxable income and, as a result, their tax obligation. The Indian Income Tax Act has provisions for offsetting losses against income from certain heads, which offers help to people and enterprises experiencing financial difficulties in particular areas.

Types of Set Off of Losses

Certainly, here is an explanation of the two types of set-off of losses under income tax, in an original manner:

- Intra Head: The process of offsetting losses within the same category of income is referred to as intra-head set-off of losses. This implies that losses incurred by an individual or organization in a particular source of income, such as a business or residential property, may be deducted from gains realized in the same category. This set-off assists in balancing gains and losses within a certain source of income, so lowering the total amount of taxable income.

- Inter Head: Utilizing losses from one category of revenue to offset gains from another is known as inter-head set-off of losses. This implies that losses incurred by an individual or business in one source of income may be applied to lower taxable income in another source of income. For instance, if an individual has incurred losses from business activities, those losses can be set off against income from salary or other sources.

Taxpayers have the chance to lessen the impact of financial setbacks by allowing losses to be subtracted from their taxable income through both intra-head and inter-head set-off of losses.

What are the few cases where the Intra-head set-off doesn’t apply?

- Only income from the speculative business can be used to offset losses from that business. and cannot be offset against any other business earnings.

- Losses from owning and maintaining horse races may be offset against earnings only from such activities.

- Only long-term capital gains may be offset by long-term capital losses.

- Long-term and short-term capital gains may be offset by short-term capital losses.

- Only profits from the specified business may be used to offset losses from that specified business. Losses from other businesses and professions, however, may be offset by revenue and profit from specified businesses.

- Losses from exempt sources of income cannot be offset by taxable income. For instance, since agricultural income is exempt from tax, a taxpayer who experiences a loss from an agricultural industry cannot offset that loss against any other taxable income.

What is the Carry Forward of losses?

The concept of “carry forward of losses” in the context of the Income Tax Act 1961, pertains to the allowance of taxpayers to offset their losses from one financial year against their future income in subsequent years. This provision helps individuals and businesses manage their tax liabilities more effectively by providing them with the opportunity to utilize their losses over a specified period.

By the Income Tax Act, taxpayers who have incurred losses in a particular financial year are permitted to carry forward these losses to subsequent years. This means that if an individual or business experiences losses in a specific category, such as business income or capital gains, they can apply these losses as deductions against their future income within the same category.

Rules for Carrying Losses forward

The set-off and carry forward of losses (Section 70 to 80):

- Income from House Property Losses: Losses under House property may be carried forward for the following 8 years if they are not fully adjusted in the same fiscal year in which they were incurred. Even when the ITR is filed beyond the deadline, under to Section 139(1), such losses may be carried forward and offset solely against income from House property.

- Non-Speculative Business Losses: Losses under business or profession (non-speculative business) may be carried forward to the next 8 assessment years if they are not fully adjusted in the same fiscal year in which they were incurred. Only income from a business or profession may be used to offset such losses and carrying them forward is only possible if the ITR is submitted on time by Section 139(1). The business from which losses are incurred doesn’t need to be still operating.

- Speculative Business Losses: Losses from speculative business can be carried forward to the next four assessment years if they are not fully adjusted in the same fiscal year in which they were incurred. Only income from the speculative business may be used to offset such losses, and Section 139(1) only permits such losses to be carried forward if the ITR is submitted on or before the deadline.

- Losses under a specified business 35AD: Losses incurred under a specified business may be carried forward indefinitely if they are not fully adjusted in the financial year in which they occurred. Only income from the specified business may be used to offset such losses under 35AD, and such losses may only be carried forward if the ITR is submitted on time (Section 139(1)).

- Losses associated with owning and handling racehorses: If losses under racehorses are not properly adjusted in the prior year in which losses were recorded, they may be carried forward for the next four fiscal years. Such losses can only be carried forward if the ITR is submitted on or before the deadline (Section 139(1)) and can be offset against revenue from owning and caring for racehorses.

- Capital Gain Losses: Capital losses may be carried forward to the next 8 assessment years if they are not fully offset in the financial year in which they were incurred.

- Only income from LTCGs, or long-term capital gains, may be used to offset long-term capital losses.

- Long-term capital gains and short-term capital gains, or LTCG and STCG, can short-term capital losses offset both.

- Losses can only be carried forward If the ITR is submitted on or before the deadline, as required by Section 139(1).

Conclusion

In conclusion, understanding the intricacies and after a brief discussion of loss set-off and carry forward of losses provisions empowers taxpayers to optimize their tax liability effectively. By strategically utilizing losses and planning for carry forward, individuals and businesses can mitigate their tax burdens and ensure a more financially secure future.