Table of contents:

What is Import Export Code:

Import Export Code is a 10 digit identification number that is issued by the DGFT (Director General of Foreign Trade), Department of Commerce, Government of India. To import or export in India, IEC Code is mandatory. No person or entity shall make any export or import without IEC Code Number.

Validity of IEC Code No.

An IEC Number allotted to an applicant shall be valid for all its branches/divisions/units/factories as indicated in the format.

Duplicate Copy of IEC Number:

Where an IEC Number is lost or misplaced, the issuing authority may consider requests for grant of a duplicate copy of IEC number, if accompanied by an affidavit.

Surrender of IEC Number:

If an IEC holder does not wish to operate the allotted IEC Number, he may surrender the same by informing the issuing authority. On receipt of such intimation, the issuing authority shall immediately cancel the same and electronically transmit it to DGFT for onward transmission to the Customs and Regional Authorities.

Application Fees and Mode of Payment for IEC Number:

Application Fee: Rs 250

Mode of Payment: In Demand Draft/Pay Order from any designated bank in favor of Zonal Point Director General of Foreign Trade or payment through EFT (Electronic Fund Transfer by Nominated Bank by DGFT like HDFC Bank, ICICI Bank, State Bank of India, UTI Bank, Punjab National Bank, Central Bank etc) or application fee can deposited by TR6 Challan with Duplicate copy in any branch of Central Bank of India and TR6 Challan need to be submit along with IEC Code application.

In the following situations, IEC is required:

- When an importer has to clear his shipments from the customs then it’s needed by the customs authorities.

- When an importer sends money abroad through banks then it’s needed by the bank.

- When an exporter has to send his shipments then it’s needed by the customs port.

- When an exporter receives money in foreign currency directly into his bank account then it’s required by the bank.

Following Documents required for Import & Export Code Registration:

- Individual’s or Firm’s or Company’s copy of PAN Card

- Individual’s voter id or Aadhar card or passport copy

- Individual’s or company’s or firm’s cancel cheque copy of current bank account

- Copy of Rent Agreement or Electricity Bill Copy of the premise

- A self-addressed envelope for delivery of IEC certificate by registered post

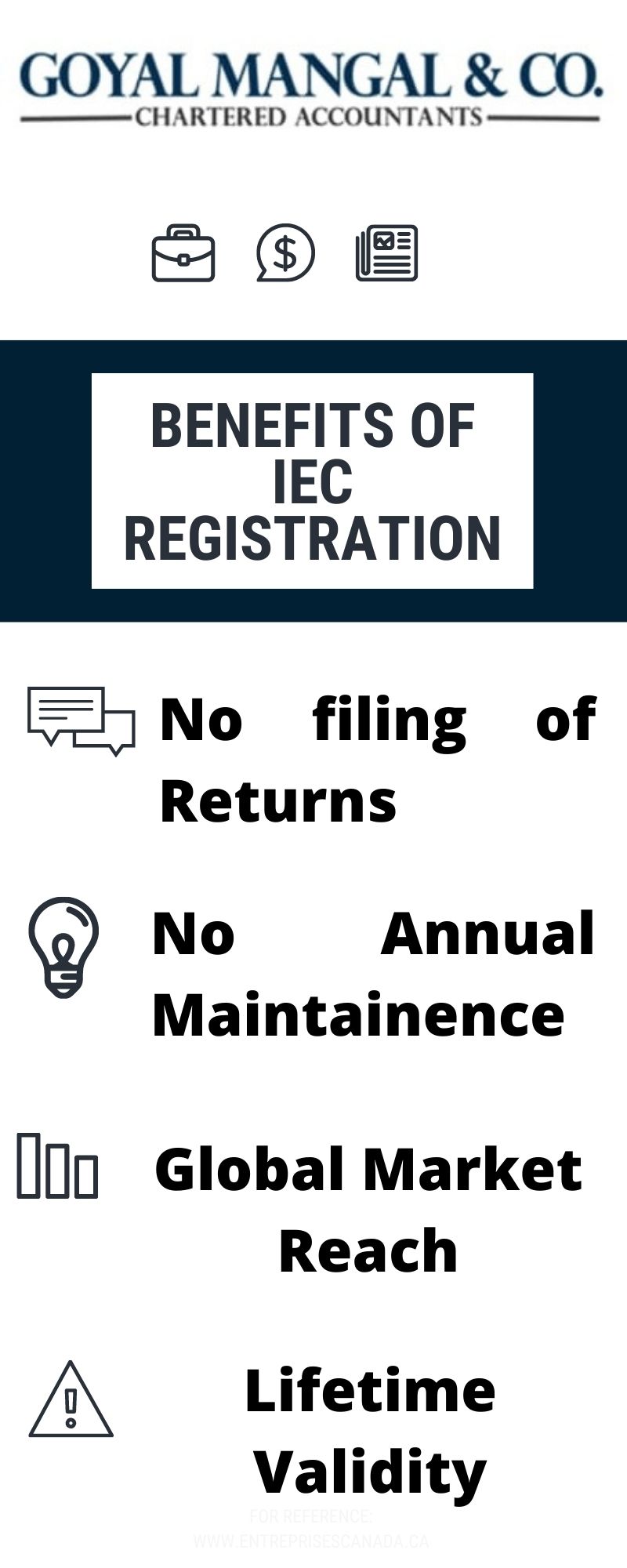

Benefits of IEC Registration:

- No Filing of Returns: IEC does not require the filing of any returns. Once allotted, there isn’t any requirement to follow any sort of processes for sustaining its validity. Even for export transactions, there isn’t any requirement for filing any returns with DGFT.

- Expansion of Business: IEC assists you in taking your services or product to the global market and grow your businesses.

- Availing Several Benefits: The Companies could avail several benefits of their imports/ exports from the DGFT, Export Promotion Council, Customs, etc., on the basis of their IEC registration.

- No Need for renewal: IEC code is effective for the lifetime of an entity and requires no renewal. After it is obtained, it could be used by an entity against all export and import transactions.

- Easy Processing: It is fairly easy to obtain IEC code from the DGFT within a period of 10 to 15 days after submitting the application. There isn’t any need to provide proof of any export or import for getting IEC code.

- Global Market Reach: As said, it is the primary requirement for the import into and export from India for the goods and specified services which enables the businesses to unlock the opportunities across the globe in the international business market. It increases the global reach of the business and hence opens the door for growth and expansion.

- Lifetime Validity: IEC registration is permanent registration which is valid for lifetime. Hence there will be no hassles for updating, filing and renewal of the IEC registration. It is valid till the Business exists or the registration is not revoked or surrendered.

- No Annual Maintenance: As there is no compliance listed, there is no requirement of annual maintenance fees to be paid after obtaining this code. There is no requirement of filings or renewal of the registration for each financial year or otherwise.

Steps Involved in Import/Export Code Registration:

Step 1: Application Form

First, you need to prepare an application form in the specified format – Aayaat Niryaat Form ANF-2A format and file it with the respective Regional office of DGFT.

Step 2: Documents

Secondly, you need to prepare the required documents with respect to your identity & legal entity and address proof with your bank details & the certificate in respect of ANF2A.

Step 3: Filing Application

Once your application is completed, you need to file with DGFT via DSC (Digital Signature Certificate) and pay the required fee for the IEC Registration.

Step 4: IEC Code

Finally, once your application is approved then you would receive the IEC Code in a soft copy from the government.

How to apply for IEC Code in case of Import and Export of Goods?

You can apply for an IEC Code, by applying to the DGFT, either online or offline. The IEC code is valid for all the branches of an organization. Only one IEC code is issued against one PAN number.

The IEC Code can be applied by following these steps:-

Step 1: Enter the following address in your browser- http://dgft.gov.in/

Step 2: Click on the ‘Online Application’ tab on the left side of the screen and from the drop down menu select ‘IEC’.

Step 3: Then choose ‘Online IEC Application’

Step 4: Enter your PAN number to login and click Next.

Step 5: Go to File and choose ‘New IEC Application details’

Step 6: Then a form will appear. Fill all the details and click ‘Upload Documents’

Step 7: Upload the relevant documents. Here are the documents that you will need:

- Individual’s or Firm’s or Company’s copy of PAN Card

- Individual’s voter id or Aadhar card or passport copy

- Individual’s or company’s or firm’s cancel cheque copy of current bank account

- Copy of Rent Agreement or Electricity Bill Copy of the premise

- A self-addressed envelope for delivery of IEC certificate by registered post

Step 8: After uploading the documents and filling the form, click on ‘Branch’ to add any branch details

Step 9: Then click on ‘Director’ to add the details of the directors in case of company

Step 10: Then click ‘EFT’ to make online payment

Step 11: Fill the amount details, which is Rs. 250 and choose your bank.

Step 12: Then a draft invoice will appear. Check the details and click on ‘Pay now’.

IEC Code and PAN Number are the same in the case of import and export of goods?

For Services exports however, IEC shall not be necessary except when the service provider is taking benefits under the Foreign Trade Policy. Consequent upon introduction of GST, IEC being issued is the same as the PAN of the firm. However, the IEC will be separately issued by DGFT based on an application.

Is IEC compulsory for import and export of goods?

IEC is mandatory for Business and commercial purposes. There is no requirement for Import/Export code for import and export goods for personal use. Hence one can import or export goods without any registration for personal use.

Who must obtain IEC code registration?

Any person who proposes to import or export goods and services from or to India must obtain Import/Export code.