From various Goods and Services Tax (GST) Returns, GSTR-6 is a return form that requires Input Service Distributors (ISDs) to report their inward supplies and distribute input tax credits (ITC) to eligible recipients within their organization or group entities. In this article, we will give a simplified introduction to GSTR-6 return filing, guiding ISD through the process and highlighting key aspects to ensure compliance with GST regulations. By understanding the fundamentals of GSTR-6, ISDs can streamline their tax filing procedures and maintain accurate records, while avoiding penalties and compliance issues.

Table of Content

What do you mean by GSTR-6 Return Filing?

GSTR-6 return filing refers to the process of submitting the GSTR-6 form, which is a return form under the GST system in India. GSTR-6 Return is filed by ISD to report the details of inward supplies received and the distribution of ITC to the eligible recipients.

The GSTR-6 return process involves providing accurate information related to the ISD’s GSTIN (Goods and Services Tax Identification Number), details of the inward supplies received from registered suppliers, and the distribution of ITC to the registered recipients.

Filing the GSTR-6 return is important as it enables ISD to comply with their GST obligations, accurately report the inward supplies and ITC distribution, and maintain proper records of input tax credit utilization within their organization or group entities.

Features of GSTR-6 Return

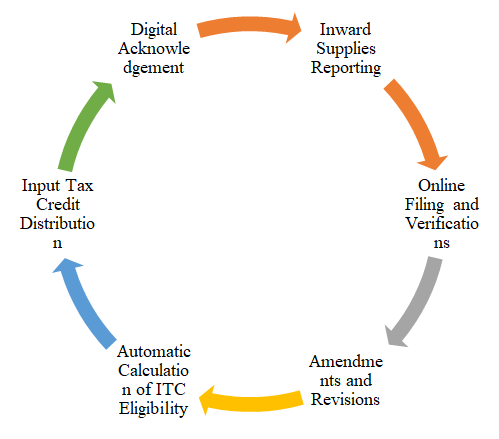

The GSTR-6 return filing process offers several features that are designed to facilitate the reporting and distribution of ITC by ISD under the GST system in India. Some key features of GSTR-6 return filing include:

Who is required to File a GSTR-6 Return?

The GSTR-6 return filing is specifically required to be done by ISD under the GST system in India. ISDs are entities that receive invoices for input services and distribute the ITC to their branches or units that are registered under GST.

Here are some key points regarding who is required to file the GSTR-6 return:

- Applicability: GSTR-6 return filing is mandatory for ISDs. If an entity is not registered as an ISD or does not fulfil the criteria of an ISD, it is not required to file the GSTR-6 return.

- Input Service Distribution: The primary role of an ISD is to distribute the ITC to the eligible recipients within the organization or group entities. As part of this process, ISDs need to file the GSTR-6 return to report the details of inward supplies received and the distribution of ITC.

- Frequency: ISDs are required to file the GSTR-6 return They need to report the relevant information for each tax period within the specified due dates.

- Recipients and Distribution Details: In the GSTR-6 return, ISDs provide information about the recipients to whom the ITC is distributed. This includes the GSTIN of the recipients and the corresponding amounts of ITC distributed.

- Record-Keeping: ISDs must maintain proper records and documentation related to the inward supplies, ITC distribution, and the filed GSTR-6 returns for future reference and audits.

Necessary documents required for GSTR-6 Return Filing

When filing the GSTR-6 return on the GST Portal in India, you may need the following documents and information readily available:

- GSTIN of the ISD: This is the unique identification number assigned to the ISD entity.

- Inward supplies details: You will need invoices and relevant documents related to the inward supplies received by the ISD from registered suppliers. This includes details such as supplier GSTIN, invoice number, invoice date, taxable value, and applicable taxes (IGST, CGST, SGST/UTGST).

- Input tax credit distribution details: The GSTR-6 return requires you to provide information about the recipients to whom the ITC is distributed. This includes their GSTIN and the corresponding amount of ITC distributed to each recipient.

- Documentation supporting ITC distribution: You should have proper documentation and records to support the distribution of input tax credits. This may include invoices, credit notes, debit notes, and any other relevant documents.

- Digital Signature Certificate (DSC) or Electronic Verification Code (EVC): Depending on the method you choose to file the GSTR-6 return, you may need a valid DSC or EVC for authentication and verification purposes.

- Previous GSTR-6 returns: It is advisable to keep a record of previously filed GSTR-6 returns for reference and audit purposes.

How to file GSTR-6 Return under GST Portal?

Here is the GSTR-6 return process on the GST Portal in India, you can follow these steps:

- Visit the official GST portal.

- Log in using your valid credentials (GSTIN and password).

- Once logged in, navigate to the “Returns” tab and select “Returns Dashboard.”

- On the Returns Dashboard page, select the financial year and tax period for which you want to file the GSTR-6 return.

- Click on the “Search” button, and the GSTR-6 return tile will be displayed. Click on the “Prepare Online” button for GSTR-6.

- The GSTR-6 form will appear on the screen. Fill in the required information accurately. The form is divided into various sections such as GSTIN of the ISD, details of inward supplies, details of the recipient, and input tax credit distribution, among others.

- Ensure that you have reconciled the ITC claimed and distributed it accurately.

- After filling in all the necessary details, click on the “Save” button to save the information entered.

- Once saved, click on the “Preview” button to review the form and verify that all the details are correct.

- If everything looks accurate, click on the “Proceed to File” button.

- The system will display a warning message to confirm that you want to freeze the GSTR-6 form. Click on “OK” to proceed.

- Next, choose the appropriate option for filing the return – “File GSTR-6 with DSC” if you want to file using a DSC or “File GSTR-6 with EVC” if you want to file using an EVC.

- Follow the on-screen instructions to complete the filing process using the chosen method.

- Once the GSTR-6 return is successfully filed, you will receive an acknowledgement with a unique reference number (ARN) on the GST portal. You can download and keep the acknowledgement for your records.

Benefits of filing GSTR-6 Return under GST

Filing the GSTR-6 return under the GST system in India offers several benefits for ISDs. Some of the key benefits of GSTR-6 return filing are:

- ITC Distribution: GSTR-6 enables ISD to properly distribute the input tax credit among eligible recipients within their organization or group entities. This ensures a fair and transparent allocation of ITC, allowing recipients to utilize the credit for offsetting their tax liabilities.

- Compliance with GST Regulations: GSTR-6 return filing ensures compliance with the GST laws and regulations. By timely and accurately filing the return, ISDs fulfil their obligations as prescribed by the GST authorities, reducing the risk of penalties, notices, or legal consequences.

- Transparent Documentation: GSTR-6 requires ISD to maintain proper records of inward supplies and ITC distribution. This promotes transparency and accountability in the distribution process, enabling easier audits and ensuring the accuracy of reported data.

- Seamless ITC Reconciliation: By filing GSTR-6 returns, ISDs can reconcile the ITC claimed with the ITC distributed. This helps in identifying any discrepancies, errors, or mismatches in the distribution process, allowing for timely rectification and minimizing potential ITC-related issues.

- Efficient ITC Management: GSTR-6 facilitates effective management of input tax credits within an organization. By filing the return, ISDs can monitor and control the ITC distribution to different recipients, ensuring optimal utilization of available credits and avoiding any misuse or misappropriation.

- Availability of ITC for Recipients: Timely filing of GSTR-6 ensures that the recipients receive their entitled share of an input tax credit on schedule. This enables them to reduce their tax liabilities and effectively manage their cash flow.

- Facilitates Business Relationships: Accurate and timely GSTR-6 return filing enhances the credibility and trustworthiness of an ISD in the eyes of suppliers and recipients. It strengthens business relationships by demonstrating compliance with GST regulations and providing a transparent mechanism for ITC distribution.

- Enhanced Efficiency and Automation: The GST portal provides a digital platform for filing GSTR-6 returns. This automated process saves time and effort for ISDs, minimizing the need for manual paperwork and reducing the chances of errors.

Takeaway

Through the above-mentioned article, we can say that As ISDs play a critical role in distributing input tax credit, understanding and effectively navigating the GSTR-6 return filing process is crucial for compliance and seamless operations. By adhering to the guidelines provided in this article, ISDs can simplify their GSTR-6 return filing, maintain accurate records, and ensure a smooth experience in meeting their GST obligations.