| Table of Content |

The word Refund in simple terms means to take back the amount of money paid to government in the form of GST at a point of time due to excess payment or any other reasons.

It is very important thattimely refund mechanism is followed, as it facilitates trade by release of blocked funds forexpansion, working capital, and modernization of existing business.

The provisions related to refund in the GST aims to standardise the refund procedures under GST regime. The claim and sanctioning procedure is completely online and time bound which is a marked departure from the existing refund process which used to be time consuming and cumbersome procedure.

Who is eligible to take refund?

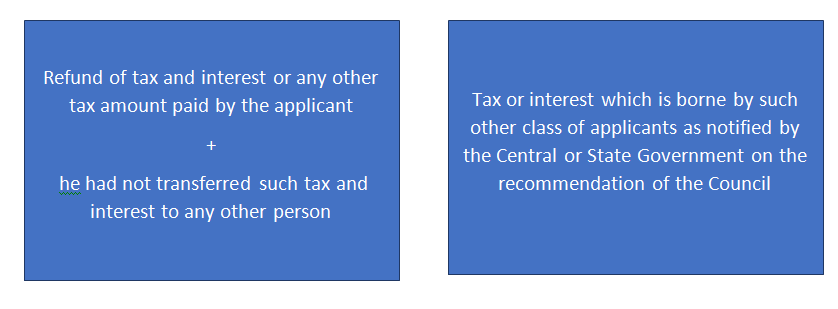

GST Refund is paid to the applicant, if such amount relates to –

On receipt of any application for GST Refund, if appointed officer is satisfied that the whole or part of the amount claimed as refund is not eligible for refund then he has the power to make an order to credited the amount to the Consumer Welfare Fund.

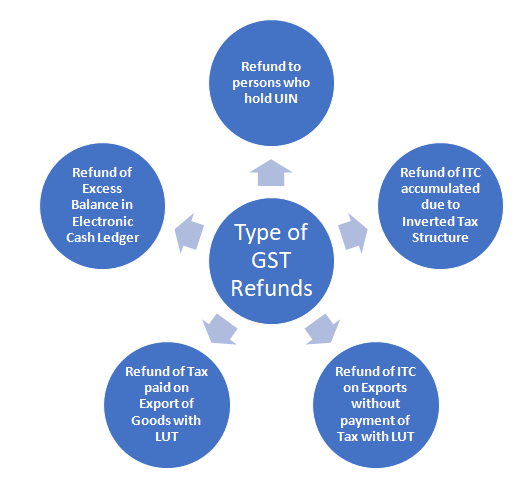

- Refund to persons who hold UIN (Unique Identification Number) : This is a special type of return for some specified class ofpersons who are not liable for tax in Indian law exp.Foreign diplomats and foreign embassies. They areallocated a Unique Identification No. (UIN) on registration,with this UIN they are eligible to claim the refund of GSTpaid by them in India in form GSTR 10 filed Quarterly.

- Refund of Excess Balance in Electronic Cash Ledger : Any Balance paid by mistake in excess in electronic cash ledger can be utilised for GST payment or if there No GST liability applicable on Taxpayer then it can be claimed as Refund by filing GST RFD 01 form.

- Refund of Tax paid on Export of Goods with LUT : This is the GST which is to be paid in absence of LUT (Letter of Undertaking) issues by the Tax Authorities. Since customs authoritygoverns the export of goods hence, there has to be a communication between both the departments i.e. GST and customs common portal. Procedure of refund of output tax paid on export of goods has been defined under CGST rules which is as follows: –

- File all the relevant returns and Shipping bills under the GSTR 3B and GSTR1

- Details of export is transmitted by the GST portal to ICEGATE which confirms the export by verification of shipping bills.

- After confirmation from different returns, Tax Authorities process the refund and credit the amount in Given Bank account in GST.

- Refund of ITC on Exports without payment of Tax with LUT : ITC accumulated on purchase of Goods & services used in production of zero-rated goods or Goods or services exported outside India are refunded by the Tax Authorities in order to provide the Full benefit of exports to the Taxpayers. In this Regard a formula has been given for the calculation of Refund allowable to assessee.Refund Amount = (Turnover of zero rated supply of goods and services) x (Net ITC)Adjusted Total Turnover Where, –

A) Refund Amount: maximum refund that is admissible;B) Net ITC: ITC on inputs and input services availed during relevant period Since there is no clarity about capital goods, we can conclude that ITC of capital is not allowed;C) Turnover of zero-rated supply of goods:All type of export of goods made during the relevant period under Bond/LUT.D) Turnover of zero rated supply of services:The turnover is calculated as follows:

Aggregate of payments received for zero rated supply of services.

Add: Zero rated supply of services which have been completed during the relevant period but payment for which has been received prior to relevant period

Less: Supplies for which advances have been received during the relevant period but for which supply is to be made after the relevant periodE) Adjusted Total turnovermeans the sum total of the value of-

-

- the turnover in a State or a Union territory, excluding the turnover of services; and

-

- the turnover of zero-rated supply of services and non-zero-rated supply of services, excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed if any, during the relevant period.

- the turnover of zero-rated supply of services and non-zero-rated supply of services, excluding-

- Refund of ITC accumulated due to Inverted Tax Structure : Inverted tax structure basically means where the rate of tax paid on input is higher than rate of tax on output supplies.Such supplies accumulates credit for which the refund can be claimed by the applicant.A formula has been prescribed in order to calculated the maximum refund:

Where, –

- A) Net ITC: ITC availed on inputs during the relevant period. Since there is no explanation regrding ITC relating to capital goods and input services, the same shall not be allowed.

- B) Adjusted Total turnoveras stated earlier in the article.

Dates For Claiming Refund

The application for refund shall be made within 2 years from the relevant date. If refund of tax and interest has been paid under protest then the limitation of 2 years shall not be applicable.

Time Limit For Granting Refund

Refund order is sanctioned within ninety days from the date of receipt of complete application of GST Refund.

If the amount is not refunded within three months from the date of receipt of application then interest at such rate as may be specified shall be payable in respect of such refund from the date immediately after the expiry of the due date till the date of refund of such tax.

Documents required for applying for GST refund

The application for refund shall be accompanied by documentary evidence in Annexure I in FORM RFD-01. Documentary evidences may vary from case to case basis: –

(i) Export of goods: – A statement should contain the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices.

(ii) Export of services: – A statement should contain the number and date of invoices and the relevant bank realization certificates or foreign inward remittance certificates.

(iii) Deemed Exports: – A statement should contain the number and date of invoices along with such other evidences.

(iv) Inverted Duty: A statement should contain the number and the date of the invoices received and issued during a tax period in a case where the claim pertains to refund of any unutilized input tax credit and credit has accumulated on account of the rate of tax on the inputs being higher than the rate of tax on output supplies, other than nil-rated or fully exempt supplies.

(v) Difference in Supply Nature: A statement should contain the details of all the transactions which are considered as intra-State supply but which is subsequently held to be inter-State supply.

(vi) Excess Payment of tax: A statement should contain the details of the amount of claim on account of excess payment of tax.

Grant of provisional refund for zero rated supply

Theproper officer appointed is required to sanction provisional refund of ninety percent of the amount of GST Refund within 7 days of GST Refund application if prima facie refund is applicable. Proper officer shall issue the grant of provisional refundinFORM RFD 04 . The aforesaid provision is applicable if the following conditions are satisfied: –

- The person claiming refund has not been prosecuted for any offence under the Act or under an existing law during any period of five years immediately preceding the tax period to which the claim for refund relates;

- The GST compliance ratingof the applicant should not be less than five on a scale of ten;

- The proceedings of any appeal, review or revision should not be pending on any of the issues which form the basis of the refund.