Welcome to From Declaration to Winding up our blog offering a concise overview of the winding-up process for companies. Winding up, also known as liquidation of a company, marks the culmination of a company’s journey, involving the orderly closure of its operations and affairs. Whether prompted by financial challenges, strategic decisions, or legal obligations, understanding the fundamental aspects of this process is essential. In this blog, we’ll explore the key methods of winding up, the stages involved, and the implications for stakeholders. Join us as we unravel the essentials of company winding up, providing clarity on an intricate facet of business operations.

| Table of Content |

Types of Winding up

According to Section 425 of the Companies Act 2013, there are two distinct types of Winding Up. The following are:

- Compulsory Winding Up under the order of the Court

- Voluntary Winding Up, of which there are two types:

- Members’ Voluntary Dissolution

- Creditor’s Voluntary Dissolution

Compulsory Winding Up under the order of the Court

A company may be wound up by court order. Also known as Compulsory Winding Up. From Declaration to Winding up Section 433 specifies the conditions under which a company may be discontinued They are listed below:

- Special Resolution: If the organization has, for specific reasons, stipulated that it be dissolved by the court. However, the court is not required to request winding up merely because the organization has agreed to do so. The power is optional and may not be exercised if doing so would be detrimental to the general populace or the organization.

- Failure to Hold Statutory Meeting: If a company has failed to deliver the statutory report to the Registrar or conduct the statutory meeting, it may be asked to be wound up.

- Absence of Business Activity or Suspension of Business: If an organization fails to commence operations within a year of its formation or suspends operations for an entire year, it may be requested to be dissolved. Again, the power is optional and will only be exercised when there is a reasonable indication that there is no intention to conduct business. The request may be denied if the suspension is described and has all the earmarks of being due to exigent circumstances.

- Decrease in Membership: If the number of people in an open organization falls below seven or in a privately owned organization falls below two, the organization may be asked to be reorganized.

- Inability to pay debts: If a company is unable to meet its financial obligations, it may be requested to be dissolved. Section 434 defines the consequences of non-payment. According to this section, an organization will be deemed unable to pay its debts in the following three instances that is Statutory Notice, Decreed Debt and Commercial Insolvency.

- Just and equitable: The final basis on which a court can order the winding of an organization is if “the court is of the opinion that the organization should be dissolved.” This provides the court with a broad discretionary ability to request winding up whenever it appears desirable. The court may give proper weight to the organization’s, its employees’, loan officers’, and investors’, as well as the general public’s, interest.

Just & equitable reasons for winding up of a company

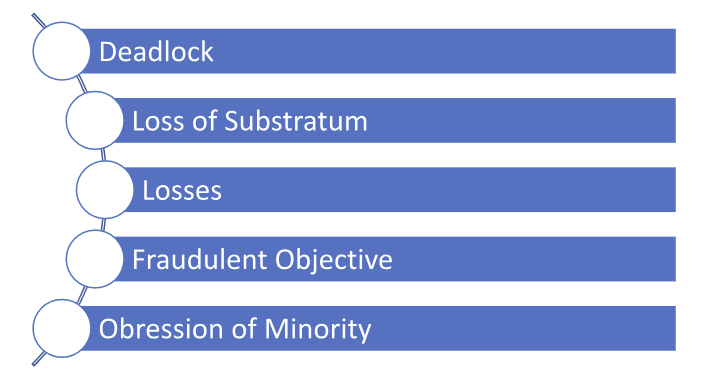

The conditions under which courts have previously wound-up organizations on this basis can be divided down into the following categories:

- Deadlock: First, when there is a deadlock in the company’s administration, it is just and equitable to order closure. The renowned example is Yenidje Tobacco Co., Ltd.

- Loss of Substratum: In addition, it is simple and fair to dissolve a business if its primary component has failed to materialize or if it has lost its foundation.

- Losses: Thirdly, it is considered just and equitable to dissolve a company when it can no longer conduct business except in exceptional circumstances. Realistically, an organization will not need to conduct business if there is no desire to achieve the goal of exchanging for a profit.

- Oppression of Minority: It is simple and fair to dissolve a company in which the key investors have adopted an aggressive, onerous, or pressuring stance towards the minority.

- Fraudulent Objective: It is straightforward and lawful to wind up a company if it was conceived and established fraudulently or for an unlawful purpose.

Voluntary Winding Up

The two methods for voluntarily wind up a business are outlined below:

- By Ordinary Resolution: An organization may be intentionally dissolved by enacting an ordinary resolution after the period, if any, specified by its articles for its duration has expired. Also, when the event, if any, for which the articles provide that the organization is to be dissolved has occurred, the organization may initiate its wilful dissolution by achieving a normal objective with that effect.

- Special Resolution: A company may at any time adopt a special resolution mandating its voluntary wound up. The process of Winding Up begins when the resolution is adopted. Within fourteen days of the resolution’s passage, the company must publish a notice of the resolution in the Official Gazette and a newspaper circulating in the district where its registered office is located. The corporate state and powers of the company shall continue until the company is dissolved, but the company shall cease operations, except as may be required for a proper winding up.

As discussed earlier in the article, there are two types of Voluntary Winding Up: - Members’ Voluntary Dissolution

- Creditor’s Voluntary Winding Up

If a Declaration of Solvency is made in accordance with the Act’s provisions, it is a Members’ Voluntary Winding Up; otherwise, it is a Creditors’ Voluntary Winding Up. The declaration must be made by most directors present at the board meeting and confirmed by affidavit. They must declare that they have conducted a thorough investigation of the company’s affairs and formed the opinion that it has no debts or will be able to pay its debts in full within a period not exceeding three years from the date the winding-up process begins.

To be effective, the declaration must be made within five weeks prior to the date of the resolution and delivered to the Registrar for registration prior to that date. It should also include a copy of the auditors’ report on the company’s profit and loss account and balance sheet as of the date of the declaration, as well as a statement of the company’s assets and liabilities as of that date.

There is a penalty for making the declarations without reasonable grounds for believing that the company can pay its debts within the specified period. If the company fails to pay its debts within that period, it will be presumed that there were no reasonable grounds for declaring bankruptcy. The liquidator must immediately convene a meeting of the creditors, as the liquidation must then proceed as if it were a Creditors’ Liquidation.

Consequences of Winding up a Company

- Financial Loss: The winding up of a business may result in significant monetary loss for shareholders and creditors. Shareholders may lose their investments, and creditors may be unable to recover their debts. This can have repercussions for the economy, especially if the company was a significant player in its industry.

- Loss of employment: The dissolution of a business frequently results in the loss of employment. Especially if they were not given adequate notice or compensation, this can have a devastating effect on their lives. Losing a career can also have repercussions on the larger community, as unemployment can reduce consumer spending and economic activity.

- Legal proceedings: Legal proceedings can also result from the dissolution of a company, particularly if shareholders, creditors, or other stakeholders are in dispute. These legal proceedings can be expensive, time-consuming, and detrimental to the company’s assets.

- Damage to Reputation: Reputational harm can also result from a company’s dissolution, both for the business and its proprietors. This can make it more challenging for owners to secure funding for future endeavours and for employees to obtain employment with other companies.

- Regulatory consequences: The dissolution of a company may also have regulatory repercussions, especially if the company failed to comply with legal or regulatory requirements. This can result in fines or legal action, and it can also affect the owners’ ability to establish a new business in the future.

Winding up a company under IBC 2016

The Insolvency and Bankruptcy Code of 2016 is one of the most important laws governing the winding up or voluntary winding up of corporate entities. Liquidation or Voluntary winding up of the company under IBC occurs when all board members of the company consent not to continue the business, dissolve the company, and pay off its debts.

Steps for winding up a company under IBC 2016

Section 59 of the IBC outlines the procedure for the orderly Winding up of a company or its voluntary winding up. Guide you through the process of winding down a company in accordance with the IBC, 2016, the following section has been summarized:

- Directors/Partners of the company submit a declaration: Most company directors are required to submit a declaration and affidavit asserting that:

There are no debts held by the company. If so, the company can pay off all its debts using the proceeds from the sale of its assets during the winding up procedure.

The windup is not initiated to defraud any individual or entity. - Convene a general meeting and pass a special resolution: The designated partners are obligated to convene a general assembly. They adopt a special resolution

Appoint an IBBI-registered Insolvency Professional (IP) as the Liquidator.

A resolution to wind up the company voluntarily due to the passage of time (if stipulated in the Articles of Association) or by mutual agreement of the members. - Registrar of Company (ROC) and IBBI: The Company is then required to notify the ROC or IBBI of the board’s decision to wind up the business. The Board and ROC must be notified within seven days of the passage of the resolution.

- The Liquidator takes over the company: Once the Adjudicating Authority issues an order for the company’s dissolution/liquidation and appoints the liquidator, the liquidator assumes full control of the company and the board of directors’ authority is suspended. The company must cooperate fully with the liquidator.

- Make a Public announcement and verify all the claims: After being appointed, the liquidator is required to make a public announcement in a vernacular language newspaper and an English language newspaper. After publication, the liquidator must consolidate all claims received from financial (secured and unsecured) creditors, operational creditors, employees, and other stakeholders.

- Prepare a list of stakeholders: In accordance with Regulation 30[1] of the Insolvency and Bankruptcy Board of India (Voluntary windup) Regulations, 2017, the Liquidator must prepare a list of all stakeholders to the wind-up process within 45 days of the last date of receipt of claims, after verifying all claims.

- Asset realisation and distribution: The liquidator may appraise and sell the corporate entity’s property and assets in any manner he deems appropriate. The liquidator must recover and realize the utmost value for all available assets.

Timelines for Completion of liquidation while winding up of the company: The wind-up procedure must be concluded within one year of the beginning of the company’s winding up/liquidation. - Final Report submission: The liquidator shall prepare and submit a final report of the process upon winding up of the company.

Conclusion

In conclusion, the winding-up process of a company is a critical phase that signifies the end of its operational journey. From voluntary decisions driven by business objectives to involuntary actions due to insolvency, understanding the impact of winding up is essential for stakeholders. Navigating the stages of wind up, asset realization, debt settlement, and distribution underscores the significance of planning and compliance. By embracing transparency, adhering to regulatory requirements, and seeking professional guidance, businesses can achieve a structured and orderly winding-up process.