In the realm of taxation, the Goods and Services Tax (GST) has revolutionized the way goods and services are taxed. Designed to create a unified tax structure, GST has brought about significant changes in various sectors, including small traders and agriculturists. This blog post aims to shed light on the GST exemption for agriculture & small…

The Input Service Distributor (ISD) plays a crucial role in simplifying the process of claiming Input Tax Credit (ITC). At the time GST came to India, the taxation system has introduced a uniform indirect tax structure and ISD is a part of this transformative structure. The article will through some light on the essential rules…

Welcome to our blog on the detention and seizure and release of goods under transit in the Goods and Services Tax (GST) system. In this blog, we aim to provide you with a concise understanding of these crucial aspects of GST transit. During the transportation of goods across state borders, it is essential to be…

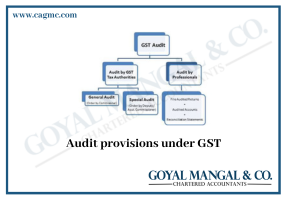

The Goods and Services Tax (GST) regime has revolutionized the indirect tax system in India. Audit provisions form a crucial component of GST, empowering tax authorities to scrutinize the financial records and activities of taxpayers. These provisions help ensure that businesses adhere to GST laws, maintain accurate records, and fulfill their tax obligations. In this…

Do you know about ITC Provisions for Fresh Registrations ?In the dynamic landscape of taxation, the implementation of the Goods and Services Tax (GST) has revolutionized the way businesses operate in India. In the GST system, one of the essential features is the Input Tax Credit (ITC), which holds significant importance for businesses. With ITC,…

The time limit for issuing invoices under Goods and Services Tax (GST) is a crucial aspect of businesses. Understanding these time limits is essential for businesses to maintain compliance and build a seamless GST workflow. From the supply of goods to the provision of services, each transaction type carries its own set of rules when…

Fixed deposits are the best strategy to save. It offers set interest and returns. All major banks offer it. India has historically preferred fixed deposits for saving and investing. FDs have been for years a secure, trustworthy, and trendy way for normal people to save and invest. But how do you know which is the…

In the world of Taxation, the concepts of composite supply and mixed supply play a significant role in determining the tax treatment of goods and services. Understanding the distinction between these two supplies of classifications are significant for businesses and tax authorities alike. In this article, we explore the complexity of composite supply and mixed…

In the world of taxation and consumer protection, the concept of anti-profiteering under the Goods and Services Tax (GST) system in India stands as a crucial safeguard. Its aim is to make sure that businesses do not unfairly capitalize on tax rate reductions or increased input tax credits at the expense of consumers. By promoting…

The implementation of the Goods and Services Tax (GST) in India has been a significant milestone in the country’s economic landscape, with its effects permeating various sectors. In the sprawling state of Rajasthan, renowned for its vibrant agricultural heritage, the impact of GST on the agricultural sector has been a subject of immense curiosity and…