| Table of Content |

Background

A partnership firm may convert into a LLP in accordance with the provisions of Sec-55 of LLP Act, 2008 read with Second Schedule.

Conversion into LLP brings out various advantages when compared to partnership firms like separate legal entity status, limited liability status, unlimited number of partners, etc.

Eligibility criteria

The main condition for conversion of partnership firm into LLP is that:

-

- “All the partners of the partnership firm will be partner of LLP”

- “No person except partners of firm will be partner of LLP”

It means when partnership firm is going to convert into LLP then partners of LLP will be same as in partnership firm. If any partner are to be added to LLP, then the firm should first be converted into LLP and then partners can be added to LLP and if partners are to be removed then firm should first be converted into LLP and then partners can be removed from LLP.

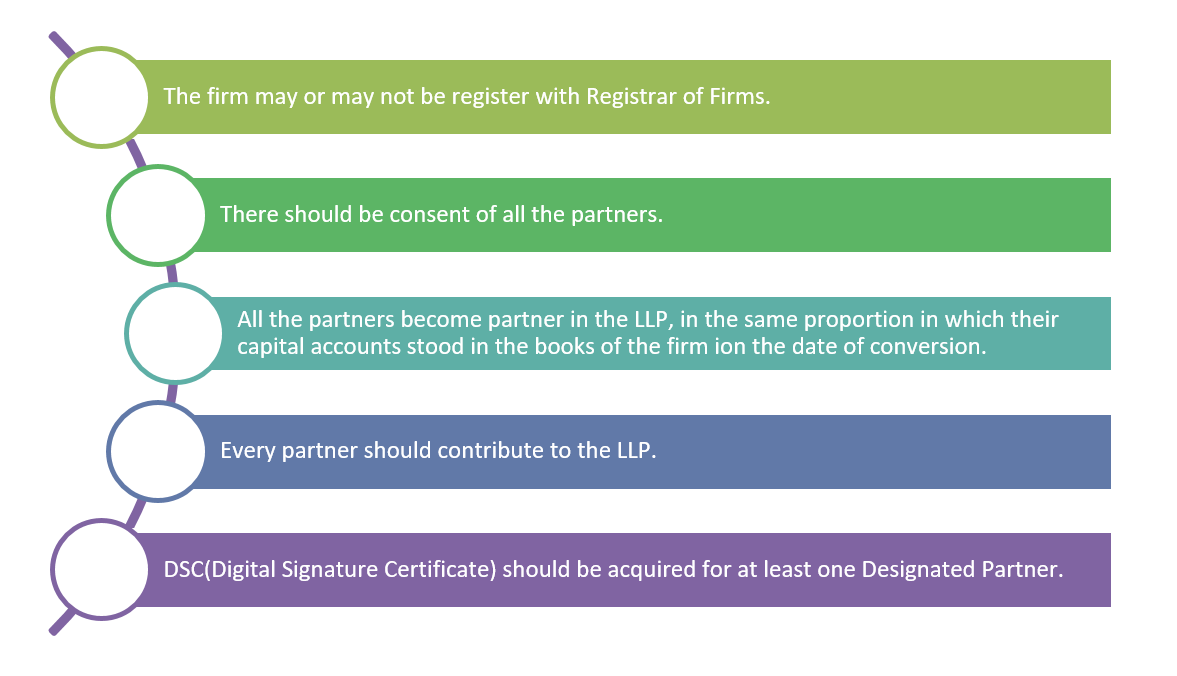

Condition for conversion of partnership firm into LLP

Key Requirements

Key Requirements

- Consent of all the unsecured/secured creditors for the proposed conversion.

- Minimum of 2 designated partners.

- Upto date filing of Income tax returns.

- Atleast 1 of the designated partners shall be an Indian Resident.

- The partners and Designated partners can be same person.

- There is no concept of share capital, but there has to be some sort of contribution from each partner.

Procedure for conversion of Partnership firm into LLP

Step 1 : Apply for Name through RUN

The first step is to search whether the proposed name of LLP is available or not. The same has to be checked on the website of Ministry of Corporate Affairs and on the trademark site by entering the respective class. If it’s found that no same name exists on both the portals then you can proceed further with applying for name in “RUN” form.

RUN form is a web based form where name of the LLP, proposed objects have to be entered. After filling the form user needs to submit it with MCA. The department will examine the same and if the name is available will issue a name approval certificate which will be valid for a period of 90 days.

Step 2: Filing of Incorporation form along with Conversion form

- Filing of Form (FiLLP) : Application for incorporation of LLP has to be filed in Form FiLLP after obtaining the Digital Signatures of any one of the Designated Partner.

Attachments of the form

-

- Form – 9 (Consent of all the partners)

- Subscriber Sheet

- Registered office Address proof (Rent Agreement, NOC from owner and Utility Bill)

- Proof of Identity and Address of Designated Partners and Partners

- In case the partners are interested in any other company or LLP, details of the same are to be annexed

- Filing of Form LLP- 17 (Conversion of Partnership firm into LLP) : Along with the incorporation form, Form 17 for conversion of partnership firm into LLP has to be submitted simultaneously.

Attachments of the form

-

- Latest Statement of Assets and Liabilities of partnership firm certified by a Chartered Accountant in practice.

- Statement of the consent of all partners of the firm.

- List of all the secured/unsecured creditors along with their consent to the conversion.

- Acknowledgement of the latest income tax return.

- Approval from any authority/body, if required.

After submission of these forms, Registrar will review the documents and issue a Certification of Registration if all the requirements are complete.

Step 3 : Filing of LLP Agreement

The next step is to draft an LLP Agreement which contains all the rules and regulation of working of an LLP. The same should be drafted in accordance with the LLP Act and Rules. LLP Agreement should be stamped and notarized and filed in LLP Form -3 within 30 days of incorporation of company.

Why LLP is better than Partnership firm?

-

- No limit to number of partners

- The liability of partners is limited to the amount of capital contributed.

- LLP is a body corporate

- LLP has a perpetual succession

- LLPs enjoys higher creditworthiness compared to partnerships

- Complete flexibility in managing the business

- Foreign Direct Investment(FDI) in LLPs is allowed

- Further professional firms are now allowed to convert themselves into LLP

- LLPs can enter into merges, amalgamation with other LLPs