Every tax system advises firms on methods to comply with laws. Firms must submit returns on time, pay taxes regularly, and retain records under a tax system. Small business owners lack the knowledge and expertise to comply with such regulatory obligations. Small enterprises can pay a composition charge. This increases compliance without the hassle of…

From various Goods and Services Tax (GST) Returns, GSTR-6 is a return form that requires Input Service Distributors (ISDs) to report their inward supplies and distribute input tax credits (ITC) to eligible recipients within their organization or group entities. In this article, we will give a simplified introduction to GSTR-6 return filing, guiding ISD through…

In the world of Taxation, the concepts of composite supply and mixed supply play a significant role in determining the tax treatment of goods and services. Understanding the distinction between these two supplies of classifications are significant for businesses and tax authorities alike. In this article, we explore the complexity of composite supply and mixed…

In India, the Goods and Services Tax (GST) regime has brought crucial changes in the taxation system, including provisions of Non-Resident Taxable Persons (NRTPs). NRTPs are individuals or businesses, whose place of businesses are not fixed but engage in taxable supplies of goods or services in India. This article provides a comprehensive overview of NRTP…

In this article, we will explore the Goods and Services Tax (GST) rates applicable in the state of Rajasthan. GST is a comprehensive indirect tax implemented throughout India to create a unified tax system. The rates are determined by the GST Council, comprising representatives from the central and state governments. Understanding the GST rates in…

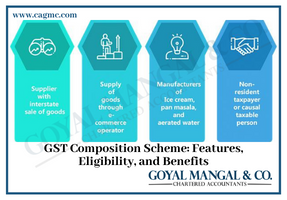

The Goods and Services Tax (GST) implementation brought significant changes to the tax landscape, aiming to streamline and unify the taxation system in various countries. As part of this transformation, the Composition Scheme under GST was set up to alleviate the compliance burden and simplify tax obligations for small businesses. In this article, we delve…

In the world of taxation and consumer protection, the concept of anti-profiteering under the Goods and Services Tax (GST) system in India stands as a crucial safeguard. Its aim is to make sure that businesses do not unfairly capitalize on tax rate reductions or increased input tax credits at the expense of consumers. By promoting…

The Goods and Services Tax (GST) has transformed the tax regime in India, introducing a unified tax structure that optimize the way of business operate. One essential aspect of GST compliance is the generation of GST invoice- Invoicing under GST, which play a crucial role in documenting and facilitating the movement of goods and services….

The implementation of the Goods and Services Tax (GST) in India has been a significant milestone in the country’s economic landscape, with its effects permeating various sectors. In the sprawling state of Rajasthan, renowned for its vibrant agricultural heritage, the impact of GST on the agricultural sector has been a subject of immense curiosity and…

The implementation of the Goods and Services Tax (GST) in India has had a significant impact on various sectors, including the start-up ecosystem. With its implementation, GST has reshaped the way businesses operate, transforming the tax regime into a unified and simplified framework. This landmark tax reform has brought both challenges and opportunities for start-ups…